US lawmaker asks Trump administration to help Malaysia crack down on chip smuggling

PositiveFinancial Markets

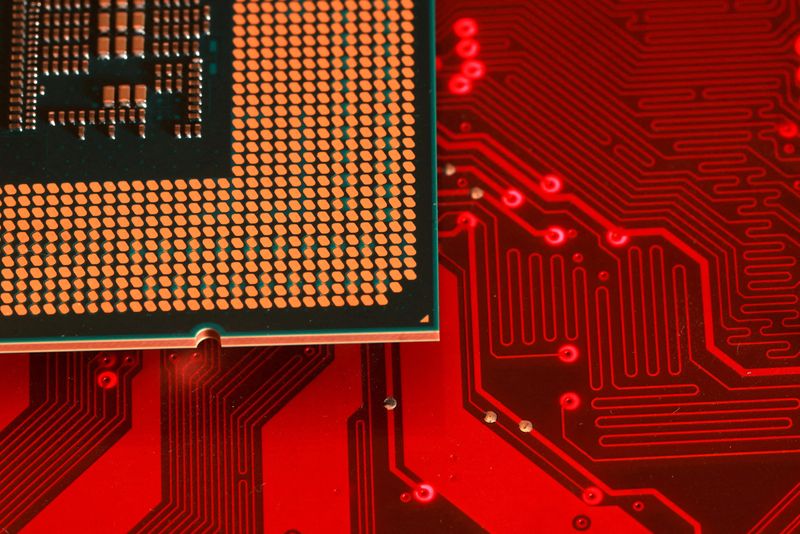

A US lawmaker has reached out to the Trump administration, urging them to assist Malaysia in combating chip smuggling. This initiative is significant as it highlights the growing concern over illegal trade practices that undermine fair competition and national security. By addressing this issue, both countries can strengthen their economic ties and ensure a more secure technological landscape.

— Curated by the World Pulse Now AI Editorial System