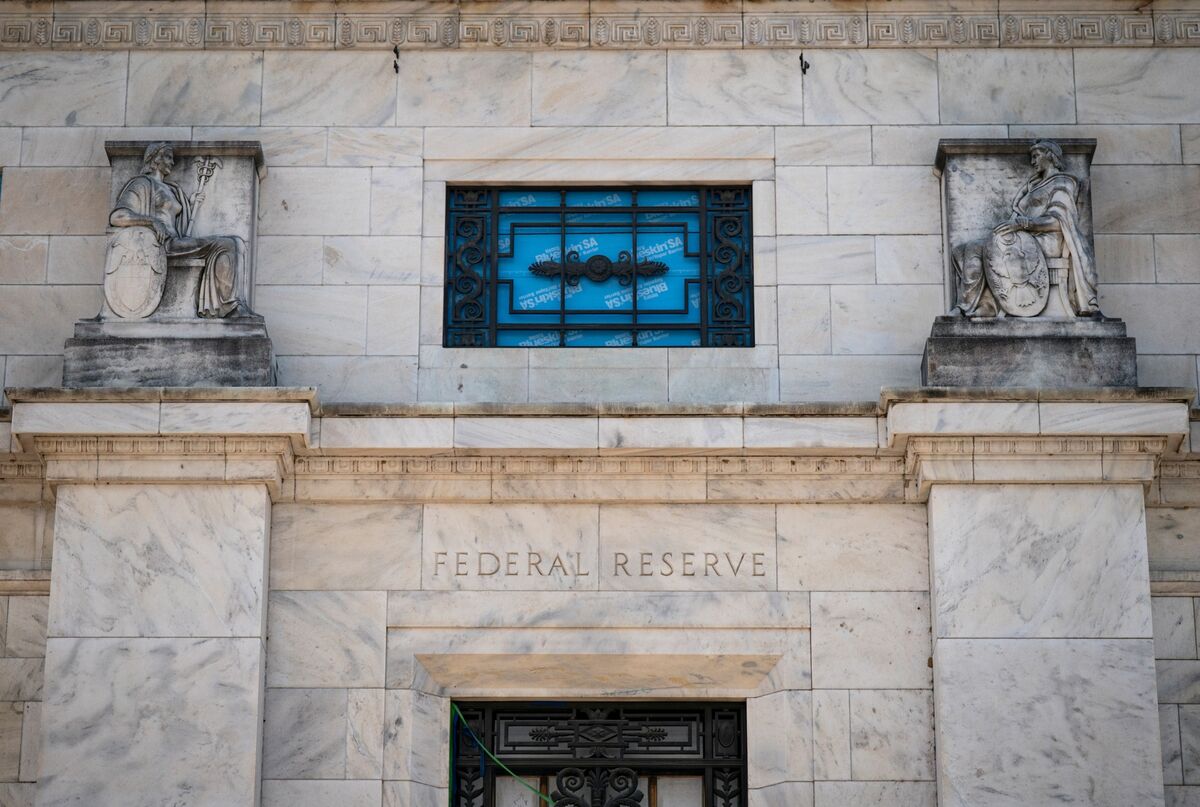

Wall St futures steady as markets eye jobless claims, PCE inflation data

NeutralFinancial Markets

Wall Street futures are holding steady as investors await key economic indicators, including jobless claims and PCE inflation data. These figures are crucial as they can influence market sentiment and guide the Federal Reserve's monetary policy decisions. Understanding these trends helps investors navigate potential market shifts.

— Curated by the World Pulse Now AI Editorial System