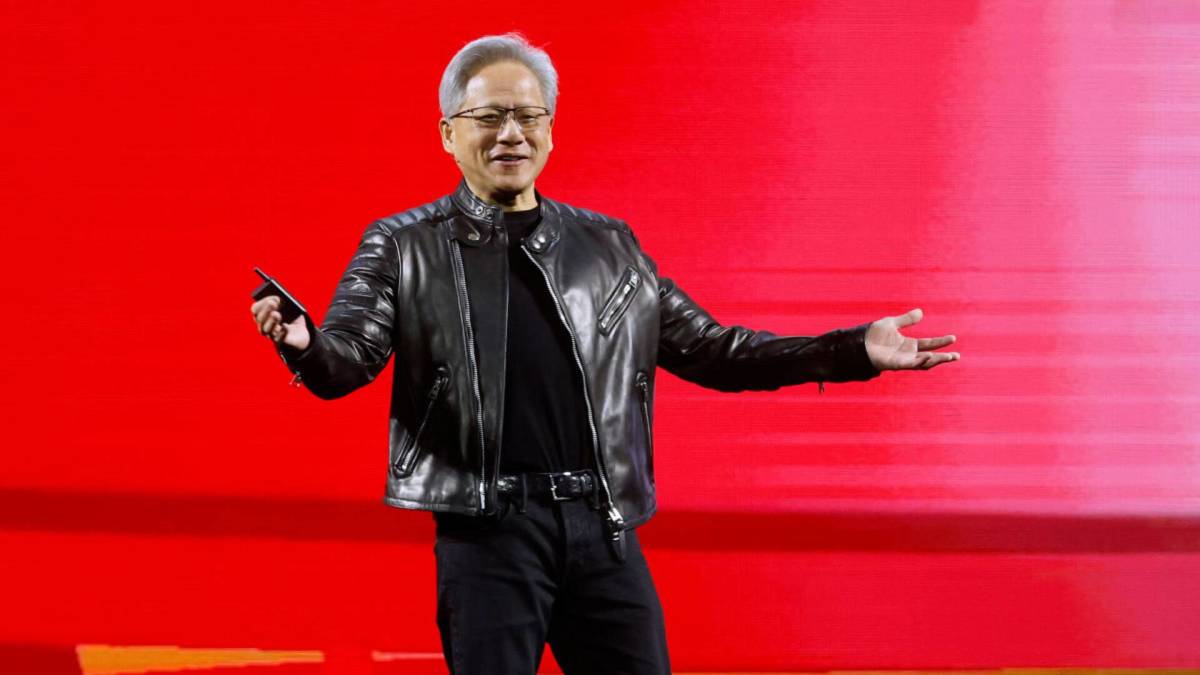

Analysts revamp Nvidia stock outlook on its investment in Intel

PositiveFinancial Markets

Analysts have upgraded their outlook on Nvidia stock after the company made a significant $5 billion investment in Intel. This move is seen as a strategic partnership that could enhance Nvidia's position in the tech industry, potentially leading to greater innovation and market growth. Investors are optimistic about the future, as this collaboration may yield positive results for both companies.

— Curated by the World Pulse Now AI Editorial System