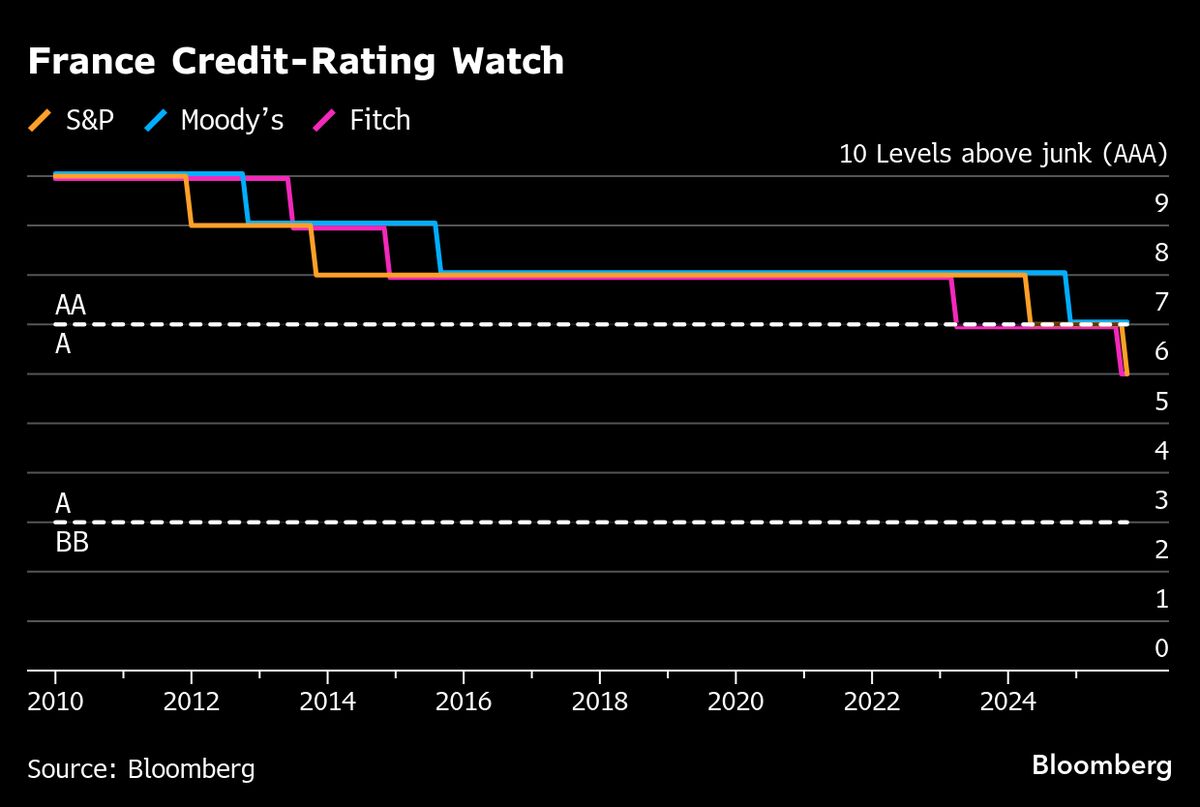

Moody’s seen slashing French credit rating, aligning with peers - Morgan Stanley

NegativeFinancial Markets

Moody's is expected to downgrade France's credit rating, a move that aligns with similar actions taken by other rating agencies. This is significant as it reflects growing concerns about France's economic stability and could impact investor confidence and borrowing costs for the government. Such a downgrade may also have broader implications for the European economy, highlighting the challenges faced by major economies in maintaining fiscal health.

— Curated by the World Pulse Now AI Editorial System