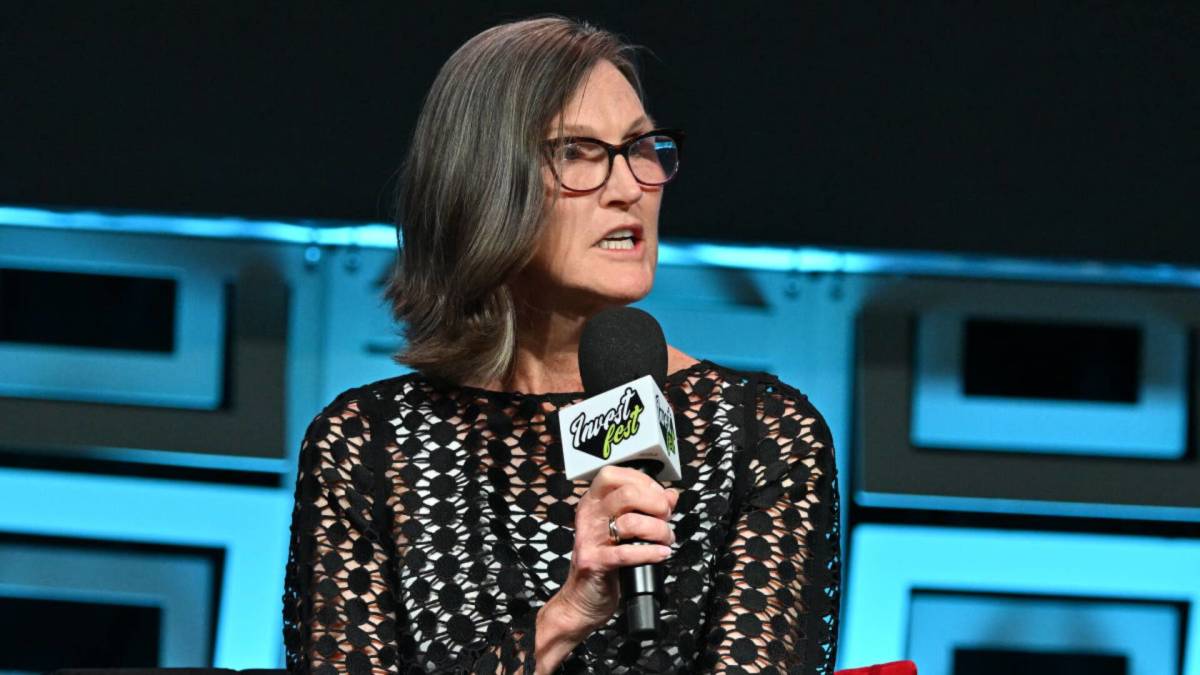

Cathie Wood makes surprising deeper bet on robotaxis

PositiveFinancial Markets

Cathie Wood's recent investment in robotaxis has caught the attention of the financial world, signaling her strong belief in the future of autonomous vehicles. This move not only highlights her confidence in the technology but also suggests that she sees significant growth potential in this sector. As the demand for innovative transportation solutions rises, Wood's deeper bet could pave the way for substantial returns, making it a noteworthy development for investors and tech enthusiasts alike.

— Curated by the World Pulse Now AI Editorial System