Digital ID cards: a versatile and useful tool or a worrying cybersecurity risk?

NeutralFinancial Markets

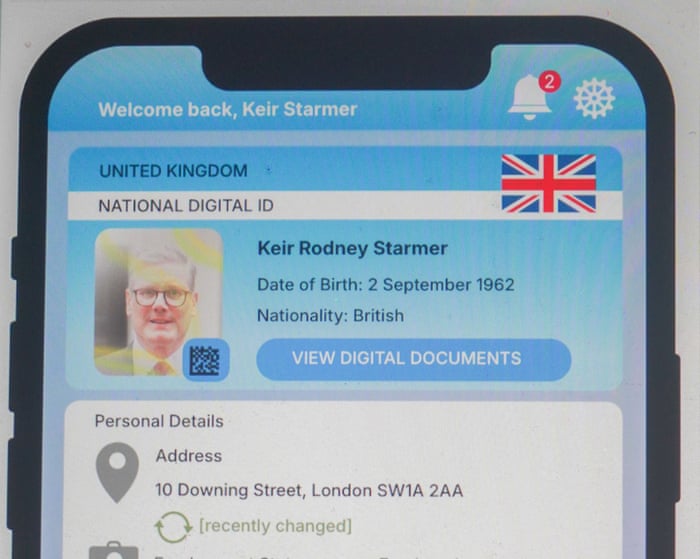

Keir Starmer is looking to revive the ID card system initially proposed by Tony Blair over two decades ago, sparking a renewed debate on its benefits and risks. The ID cards were intended to address issues like illegal working and streamline access to public services. However, concerns about cybersecurity and privacy persist, making this a significant topic for public discussion as it could impact how citizens interact with government services in the future.

— Curated by the World Pulse Now AI Editorial System