Tech Giants Fuel Wall Street's Cautious Comeback

NeutralFinancial Markets

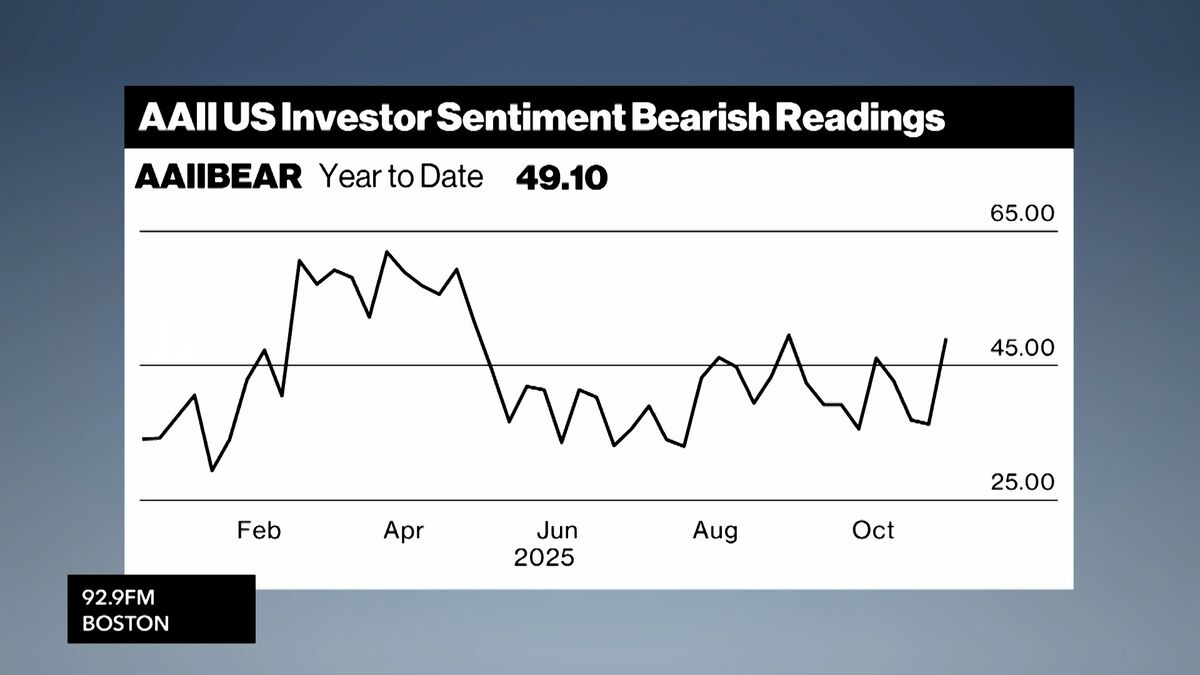

The current surge in AI investments, particularly in cloud and data centers, is indicative of a broader trend in the tech sector. As highlighted by Bloomberg's Ed Harrison, while there are concerns about a tech bubble, the potential for a 'technology revolution' suggests that stocks like Nvidia are still appealing. This is especially pertinent as Wall Street has seen heavy selling, making Nvidia's upcoming earnings report crucial. The recent selloff in tech giants underscores the volatility in the market, emphasizing the importance of upcoming economic data and earnings reports in shaping investor sentiment.

— via World Pulse Now AI Editorial System