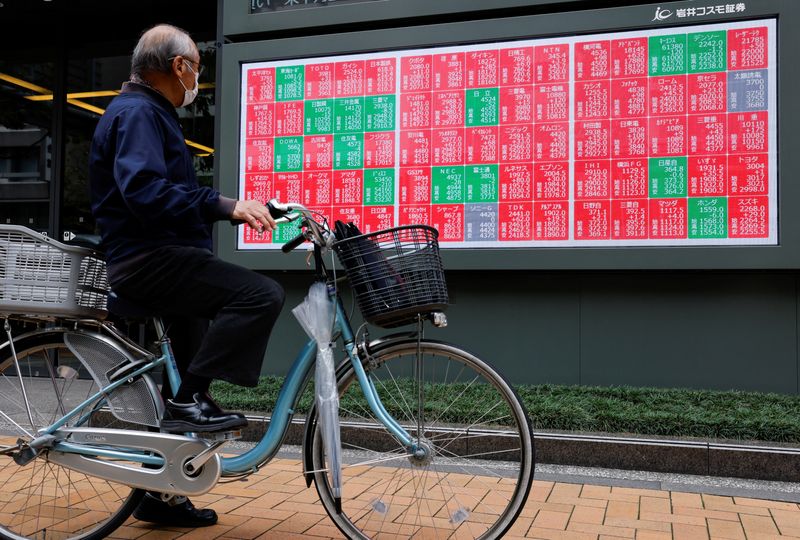

Nikkei extends record rally as Japan makes history with first female PM

PositiveFinancial Markets

Japan has made history by appointing its first female Prime Minister, a significant milestone that has sparked a record rally in the Nikkei index. This development not only marks a breakthrough in gender representation in politics but also reflects a shift in societal attitudes towards leadership roles. Investors are optimistic about the potential for progressive policies and economic reforms under her leadership, making this a pivotal moment for Japan's future.

— Curated by the World Pulse Now AI Editorial System