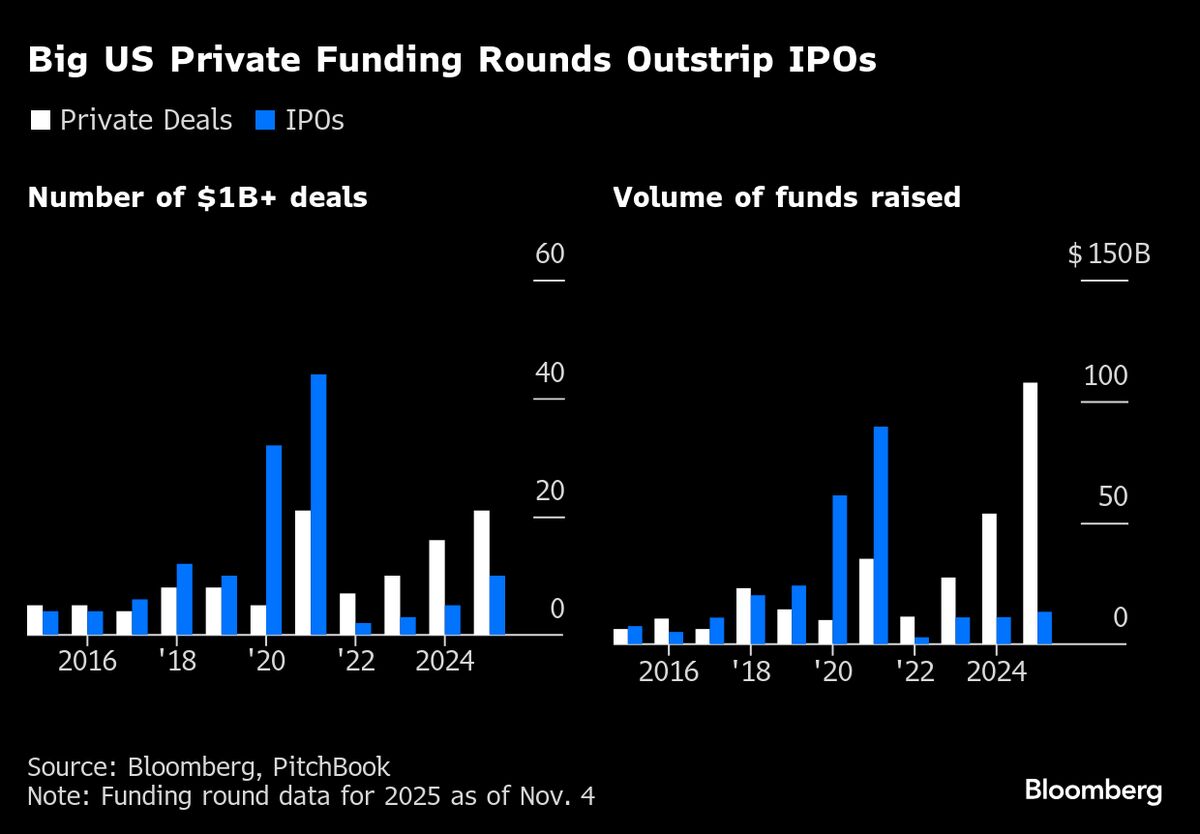

Number of Billion Dollar US IPOs Falls Far Behind Private Rounds

NegativeFinancial Markets

Number of Billion Dollar US IPOs Falls Far Behind Private Rounds

The number of billion-dollar IPOs in the US is significantly lagging behind private funding rounds, highlighting a troubling trend for public markets. As private companies secure multibillion-dollar investments at a rapid pace, many fast-growing startups, particularly in the artificial intelligence sector, are choosing to stay private. This shift raises concerns about the attractiveness of public offerings and the future landscape of tech investments.

— via World Pulse Now AI Editorial System