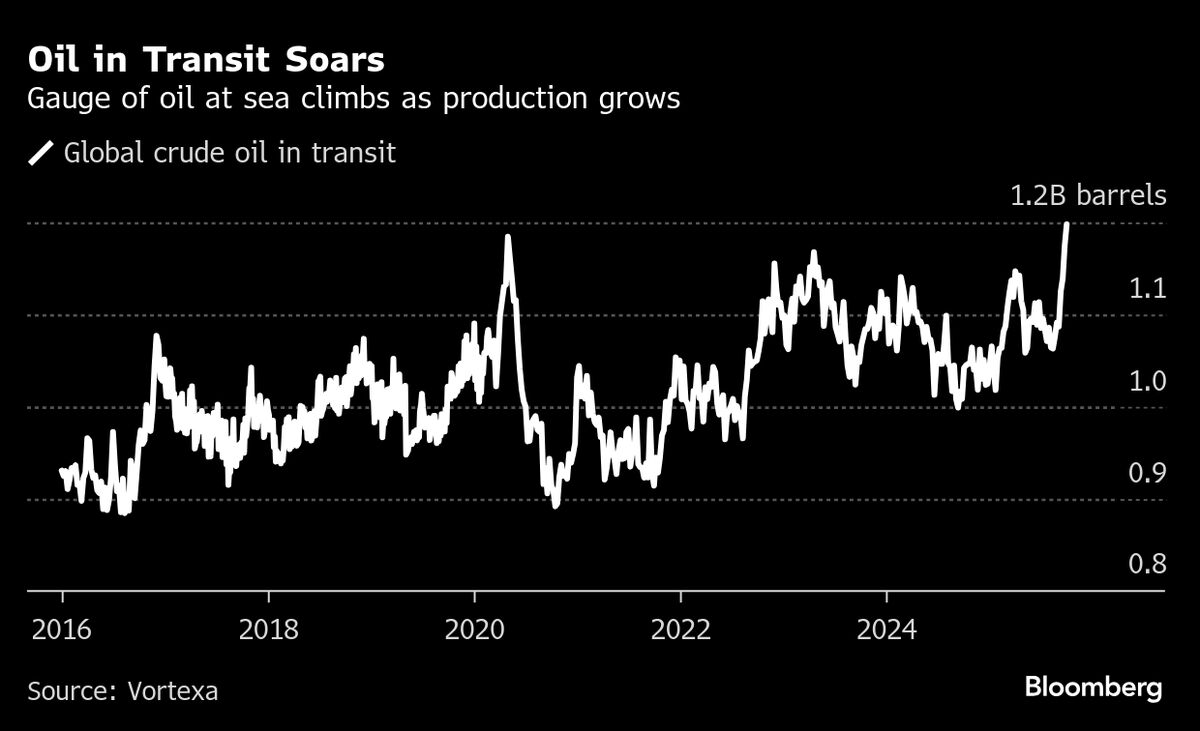

Global Oil at Sea Climbs to a Record as Production Surges

PositiveFinancial Markets

The global oil market is experiencing a significant surge as the amount of oil transported by tankers reaches a record high. This increase is driven by ramped-up production from key oil-producing nations, indicating a robust recovery in the industry. This matters because it reflects growing demand and could impact global oil prices, influencing economies worldwide.

— Curated by the World Pulse Now AI Editorial System