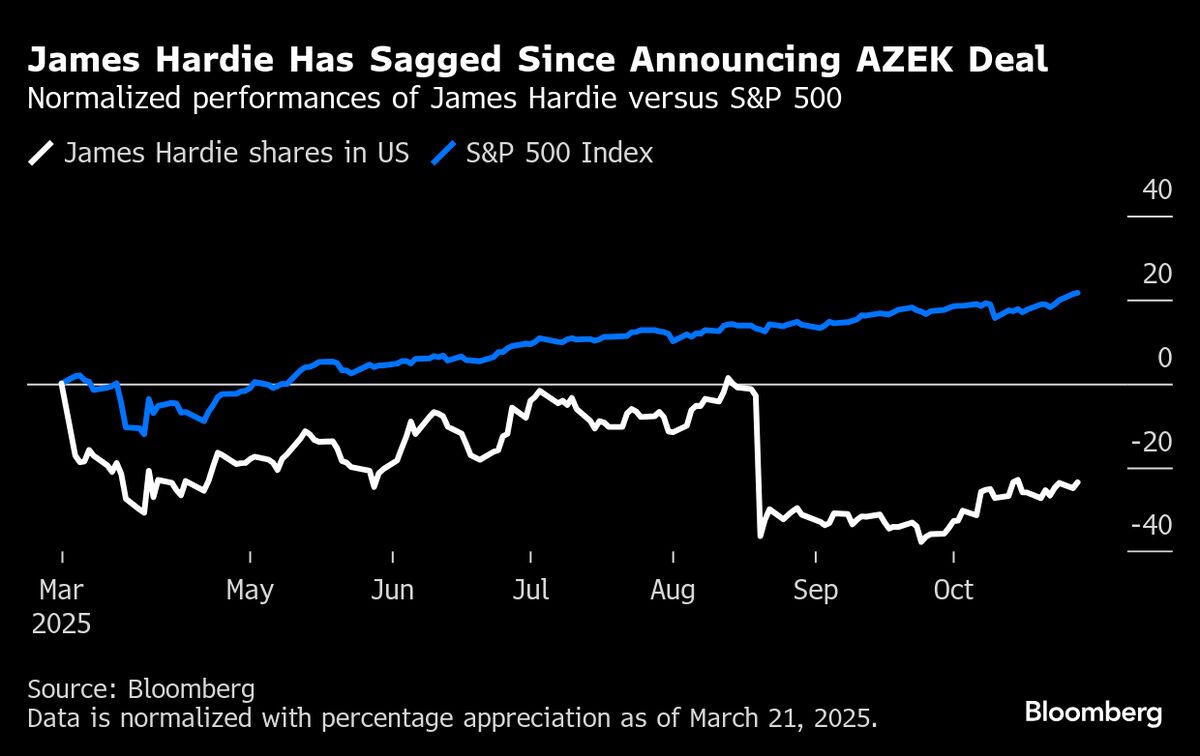

James Hardie Investors Oust Chair After Divisive AZEK Deal

NegativeFinancial Markets

In a significant move, James Hardie Industries Plc investors have removed Chair Anne Lloyd following a controversial $8.4 billion acquisition of AZEK Co. The decision to proceed with the deal without a shareholder vote sparked outrage among investors, highlighting tensions over corporate governance and decision-making processes. This incident underscores the importance of transparency and shareholder involvement in major corporate actions, as stakeholders demand more accountability from leadership.

— Curated by the World Pulse Now AI Editorial System