Bessent Says US Negotiating $20 Billion Swap Line With Argentina

PositiveFinancial Markets

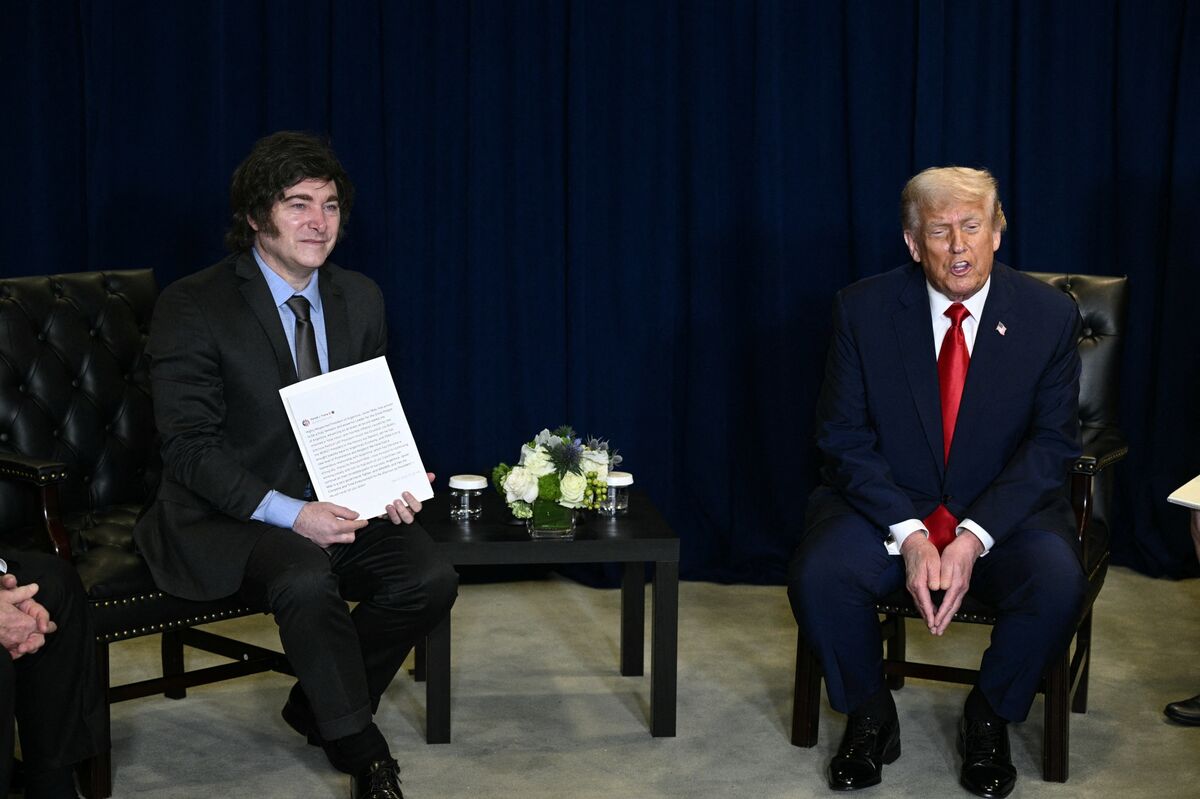

The U.S. is in talks to establish a $20 billion swap line with Argentina, as Treasury Secretary Scott Bessent announced. This move is significant as it provides President Javier Milei with crucial financial support ahead of the important midterm elections next month. By potentially purchasing Argentina's dollar bonds, the U.S. aims to stabilize the country's economy, which could have positive implications for both nations.

— Curated by the World Pulse Now AI Editorial System