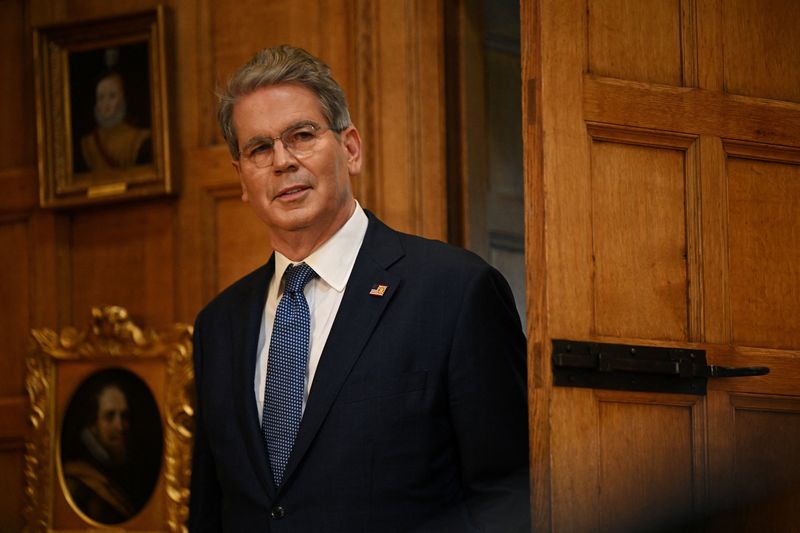

Miran Says Interest Rates Should Fall to 2.5 Percent

PositiveFinancial Markets

Miran has suggested that interest rates should be lowered to 2.5 percent, a move that could stimulate economic growth and make borrowing more affordable for consumers and businesses. This recommendation is significant as it reflects a shift in monetary policy that could lead to increased investment and spending, ultimately benefiting the economy.

— Curated by the World Pulse Now AI Editorial System