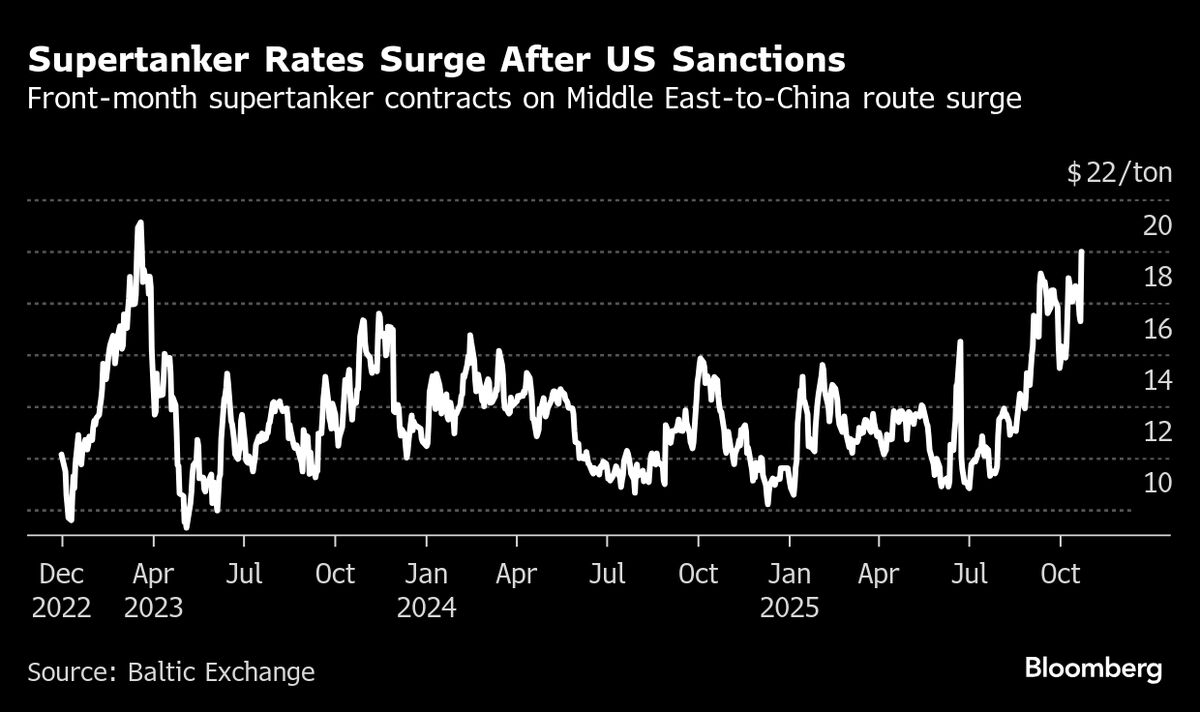

Will India and China Be Able to Resist U.S. Sanctions on Russian Oil?

NeutralFinancial Markets

India and China have continued to purchase Russian crude oil despite U.S. pressure to halt these transactions. This situation highlights the complex geopolitical dynamics at play, as both nations navigate their energy needs while facing potential repercussions from U.S. sanctions. The ability of these countries to maintain their oil imports could significantly impact global energy markets and international relations.

— Curated by the World Pulse Now AI Editorial System