'Transparency Will Help' in Private Credit: Oaktree PM

PositiveFinancial Markets

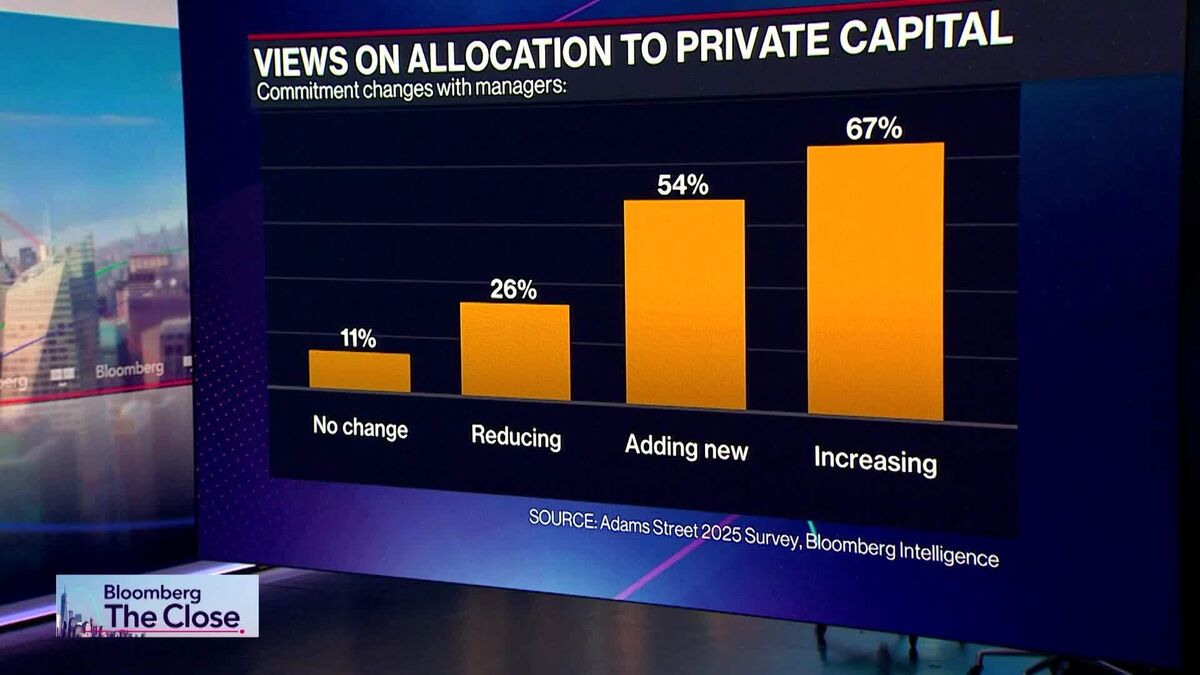

Christina Lee from Oaktree highlights the growing interest in mezzanine debt, a niche product that offers fixed rates and the ability to lock in yields. This trend is significant as it reflects investors' desire for stability in uncertain markets, making it a timely topic for those looking to diversify their portfolios.

— Curated by the World Pulse Now AI Editorial System