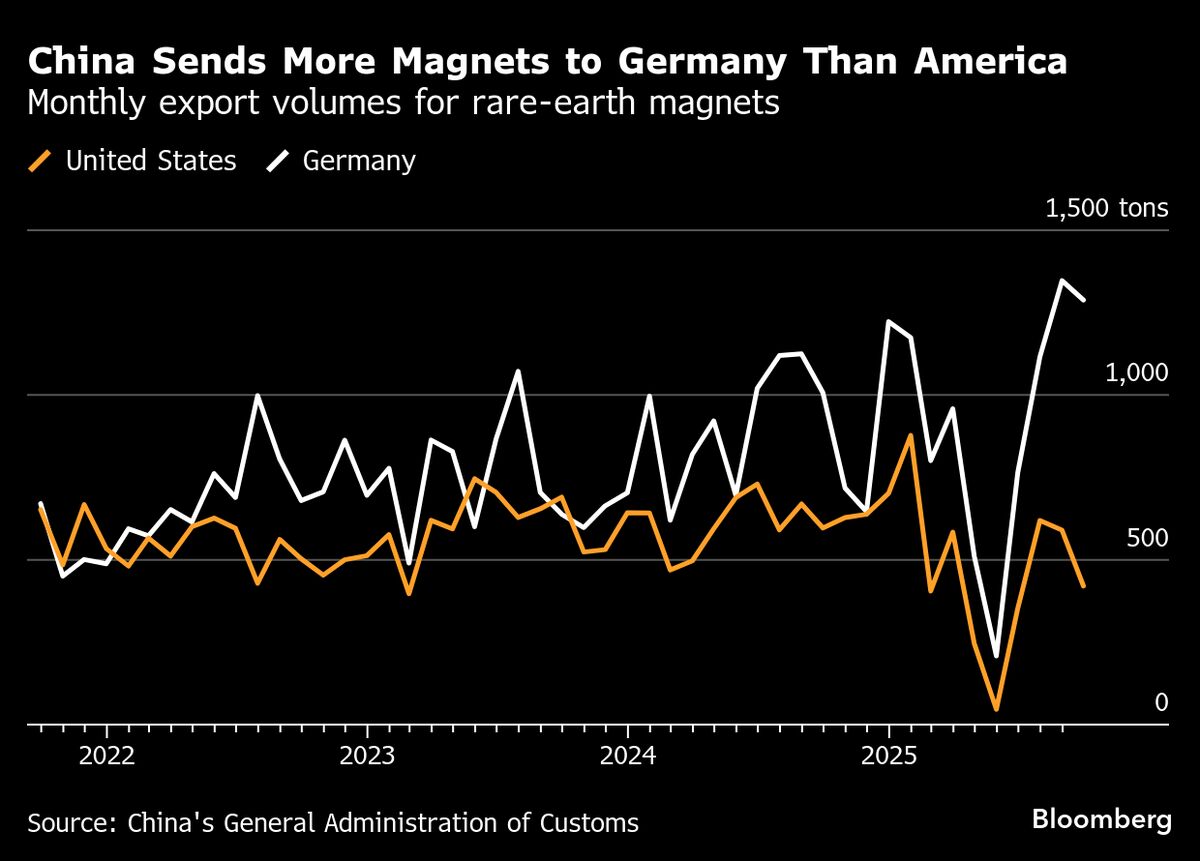

European Magnet Maker Warns of Rare Earth Crisis Without Action

NegativeFinancial Markets

- A German magnet maker has cautioned that Europe faces a rare earth crisis unless it significantly reduces its reliance on Chinese imports. The establishment of a new plant in the US underscores the urgency of this situation, as the company seeks to mitigate supply chain vulnerabilities.

- This development is crucial for the company as it aims to secure a stable supply of rare earth materials, which are vital for manufacturing magnets used in various applications, including renewable energy technologies and electric vehicles.

- The broader context reveals ongoing concerns within Europe regarding resource dependency, as seen in recent EU plans to restrict aluminum scrap exports. This reflects a growing awareness of the need for strategic resource management to support decarbonization efforts and ensure access to essential materials.

— via World Pulse Now AI Editorial System