Fed's Powell said central bank is cutting 10% of its staff

NegativeFinancial Markets

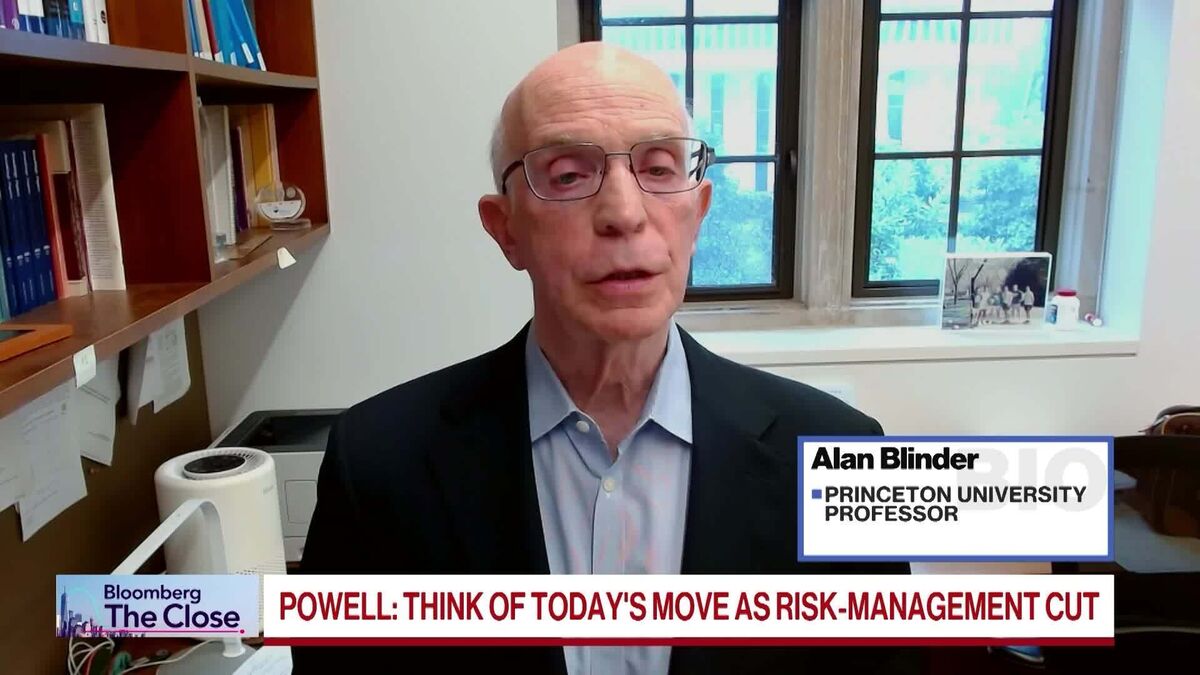

In a recent announcement, Jerome Powell, the chair of the Federal Reserve, revealed that the central bank will be reducing its workforce by 10%. This significant cut reflects the institution's efforts to streamline operations amid economic challenges. Such layoffs can have a ripple effect on the job market and raise concerns about the overall health of the economy, making it a crucial development to watch.

— Curated by the World Pulse Now AI Editorial System