Philippines Halts Currency Trading as Storm Bualoi Shuts Offices

NegativeFinancial Markets

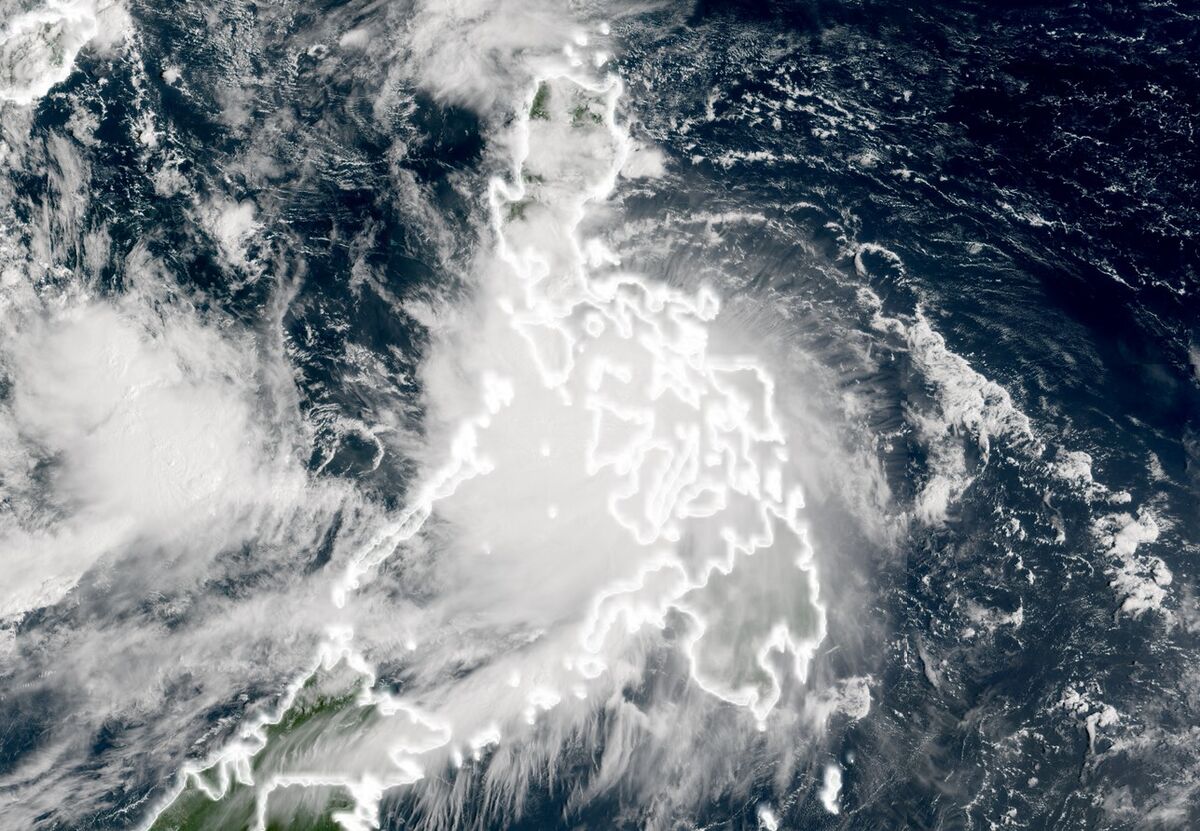

The Philippines has announced a suspension of currency trading due to Severe Tropical Storm Bualoi, which is impacting government operations across the archipelago. This decision highlights the storm's severity and the government's commitment to safety, but it also raises concerns about economic disruptions during this critical time.

— Curated by the World Pulse Now AI Editorial System