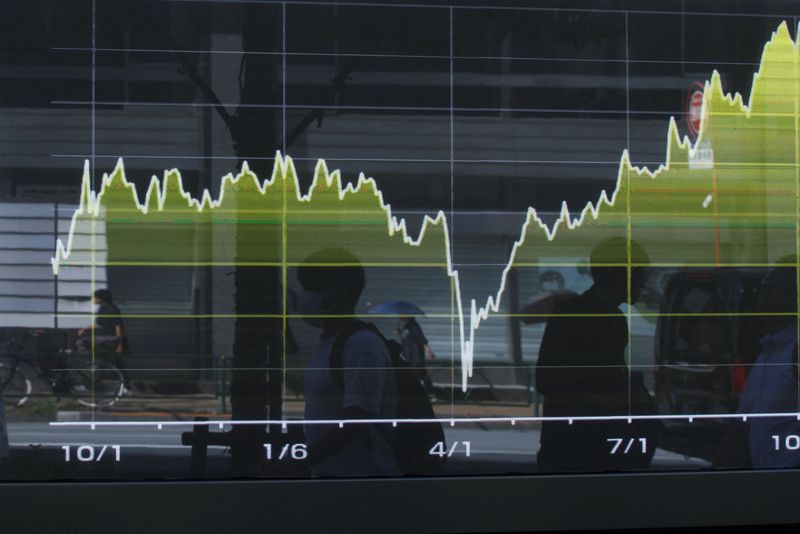

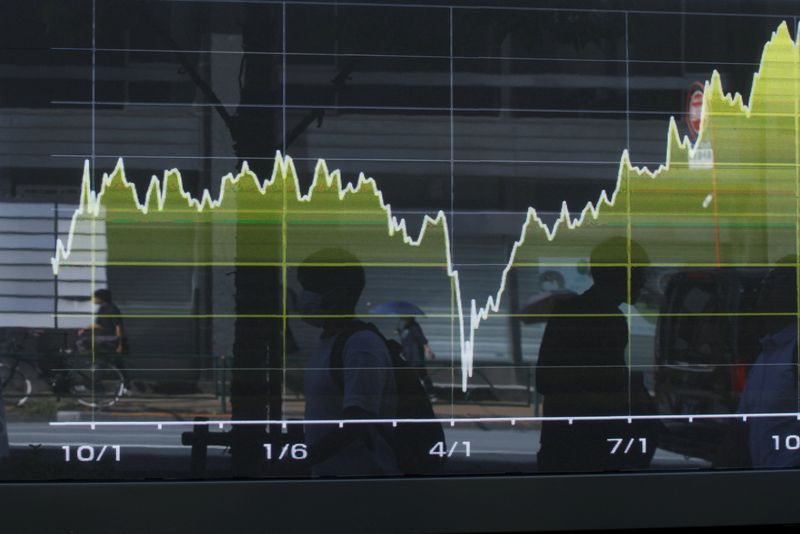

Investors warn on leveraged loan risks after First Brands collapse

NegativeFinancial Markets

Investors are raising alarms about the risks associated with leveraged loans following the collapse of First Brands. The rapid expansion of the $2 trillion market has resulted in rushed deals and insufficient due diligence, according to fund managers. This situation is concerning as it highlights potential vulnerabilities in the financial system, which could lead to broader economic implications if not addressed.

— Curated by the World Pulse Now AI Editorial System