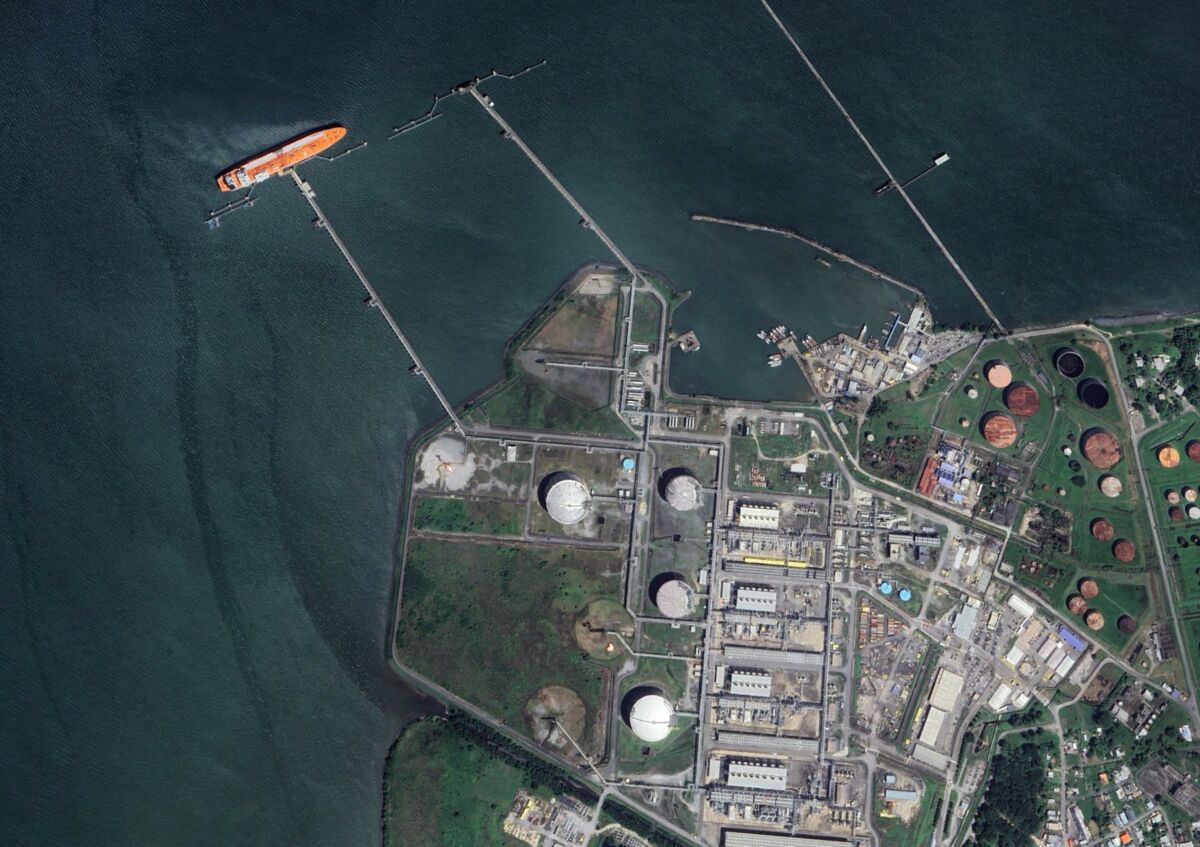

Shell Nears US License to Export Venezuelan Gas to Trinidad

PositiveFinancial Markets

Shell Plc is on the verge of receiving a US license that would allow it to export Venezuelan gas to Trinidad and Tobago. This development is significant as it indicates a potential easing of sanctions, which could lead to increased energy collaboration in the region. The project not only promises to boost Shell's operations but also supports Trinidad and Tobago's energy needs, highlighting a shift in US policy that could benefit both countries.

— Curated by the World Pulse Now AI Editorial System