Stocks Churn as US Job Cuts Jump; US Reduces 10% of Flights on Shutdown | Bloomberg Brief 11/06/2025

NegativeFinancial Markets

Stocks Churn as US Job Cuts Jump; US Reduces 10% of Flights on Shutdown | Bloomberg Brief 11/06/2025

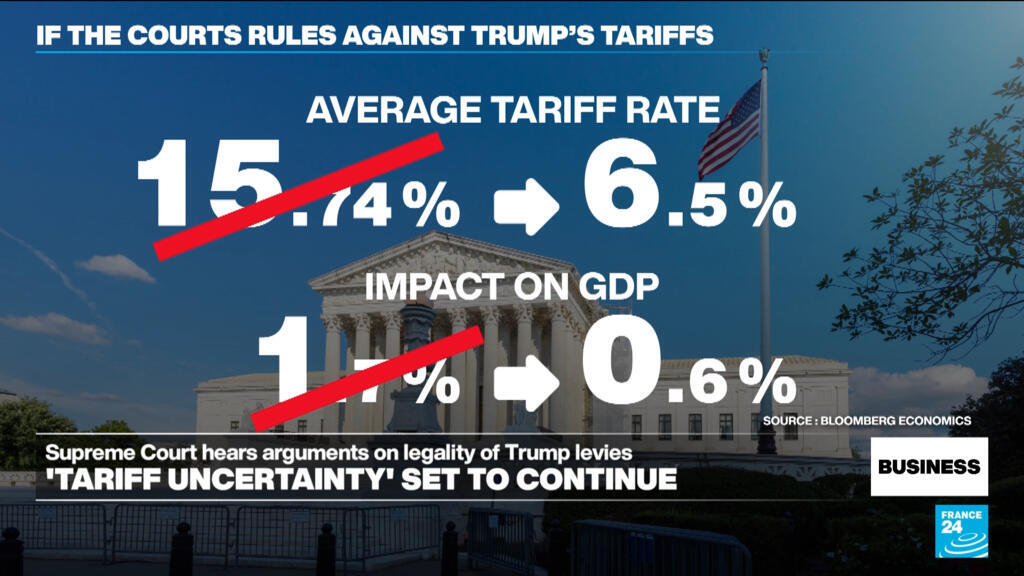

The recent surge in job cuts in the US, reaching a seven-month high, has led to a weakening of the US dollar and increased speculation about a potential rate cut by the Federal Reserve in December. Additionally, the government shutdown is prompting a 10% reduction in flights, further complicating the economic landscape. With the US Supreme Court expressing skepticism about President Trump's ability to enforce his tariffs, the full impact of these policies remains uncertain. This situation highlights the fragility of the labor market and the broader economic implications.

— via World Pulse Now AI Editorial System