EUR/USD near-term price forecast after the French blip

NeutralFinancial Markets

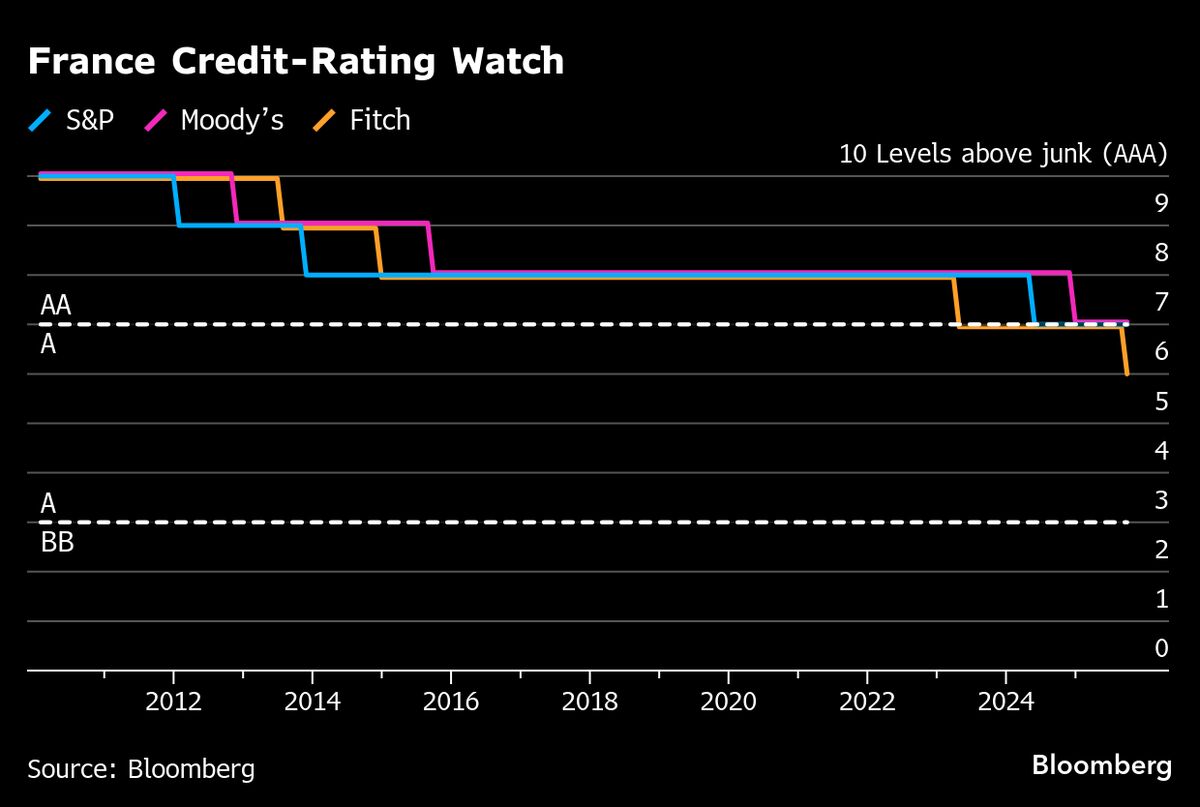

The EUR/USD currency pair is experiencing fluctuations following recent developments in France, which have impacted market sentiment. Traders are closely monitoring these changes as they could influence the euro's strength against the dollar. Understanding these dynamics is crucial for investors looking to navigate the forex market effectively.

— Curated by the World Pulse Now AI Editorial System