Stocks Go 24-7 in Crypto Betting Markets With 100x Leverage

NeutralFinancial Markets

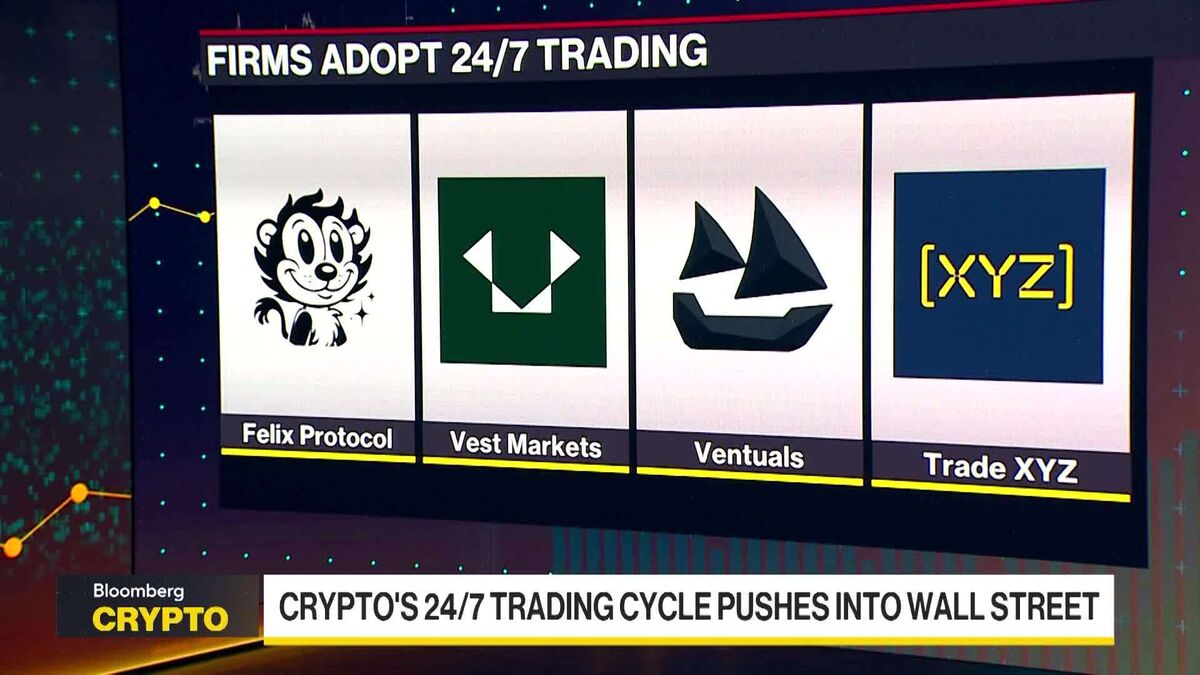

- The perpetual swap, a derivative product from the cryptocurrency market, is being adapted for the US stock market, allowing for continuous trading without the need for brokers or a closing bell. This innovation reflects a significant shift in trading practices, enabling traders to engage with traditional assets similarly to digital currencies.

- This development is crucial as it represents a merging of cryptocurrency trading strategies with traditional finance, potentially attracting a new demographic of traders who prefer the flexibility of 24/7 trading.

- The adaptation of such trading models highlights ongoing volatility in the cryptocurrency market, as Bitcoin has seen a notable decline, raising questions about its stability compared to traditional assets. This trend suggests a broader reevaluation of investment strategies across both digital and conventional markets.

— via World Pulse Now AI Editorial System