Corporate America is trying to tell us something about the economy, top analyst says: a 3-year recession for ‘much of the private economy’ ended in April

PositiveFinancial Markets

Corporate America is trying to tell us something about the economy, top analyst says: a 3-year recession for ‘much of the private economy’ ended in April

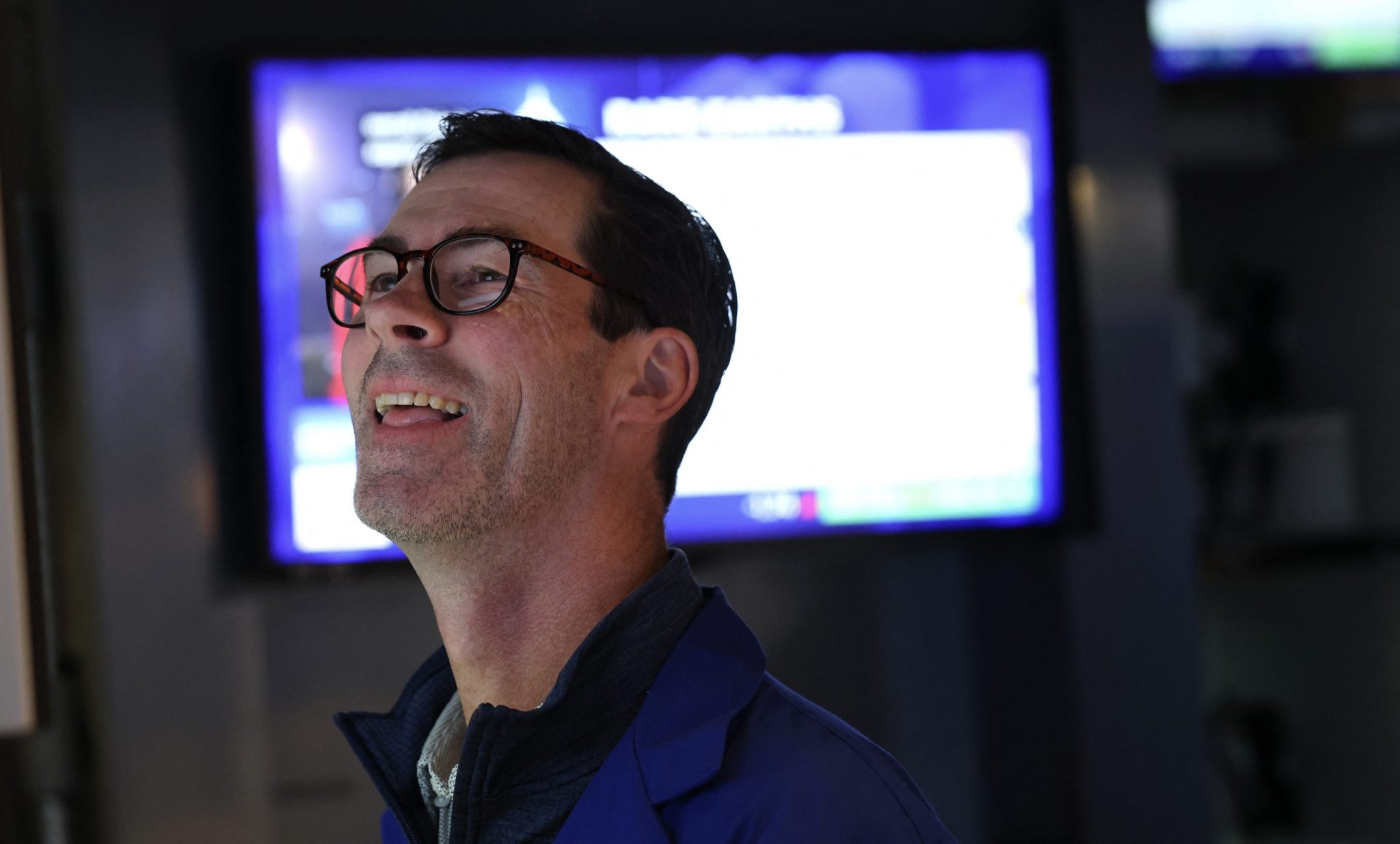

Morgan Stanley's Mike Wilson, who previously warned of a 'rolling recession' while others predicted a boom, now believes that a 'rolling recovery' has begun. This shift is significant as it suggests that the private economy, which faced challenges for three years, is starting to rebound. Wilson's insights could influence investor confidence and market strategies moving forward.

— via World Pulse Now AI Editorial System