Stocks Are Outrunning Tariff Risks as Earnings Expectations Rise

PositiveFinancial Markets

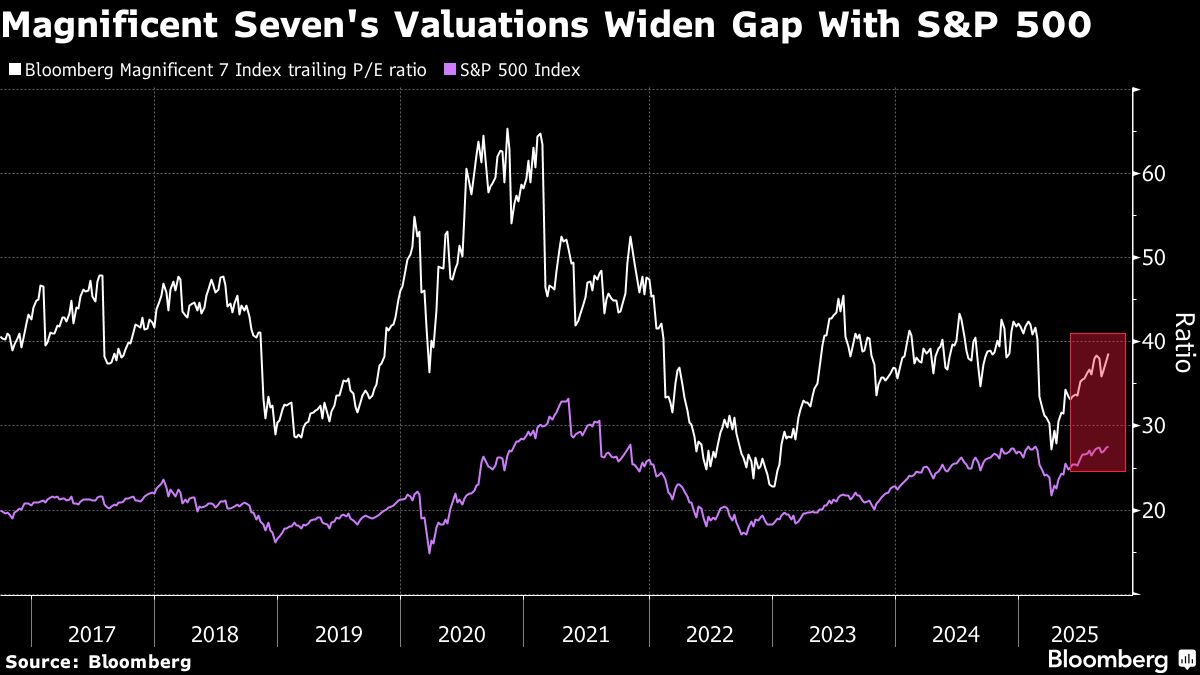

US stocks are hitting record highs as we approach earnings season, with rising expectations for corporate profit growth. This is significant because it suggests that the market rally may continue, reflecting investor confidence in the economy despite potential tariff risks.

— Curated by the World Pulse Now AI Editorial System