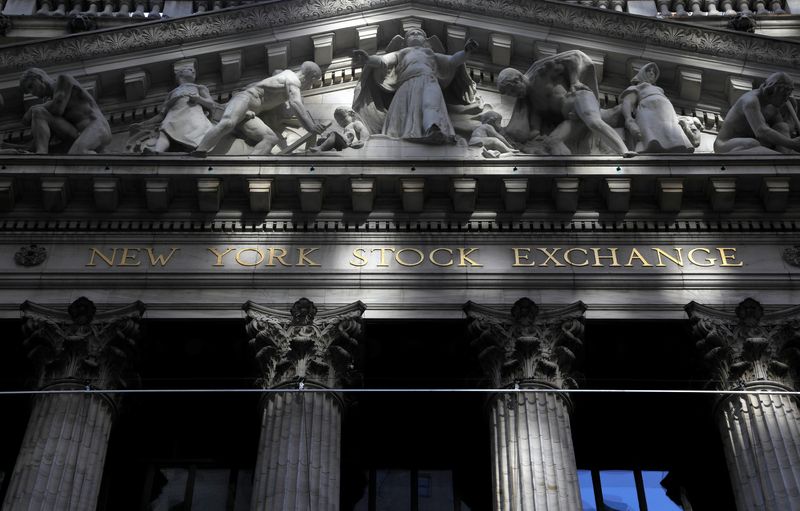

Evommune files for proposed NYSE IPO

PositiveFinancial Markets

Evommune has officially filed for an initial public offering on the NYSE, marking a significant step in its growth journey. This move is important as it reflects the company's confidence in its business model and potential for expansion, attracting investor interest in the biotech sector.

— Curated by the World Pulse Now AI Editorial System