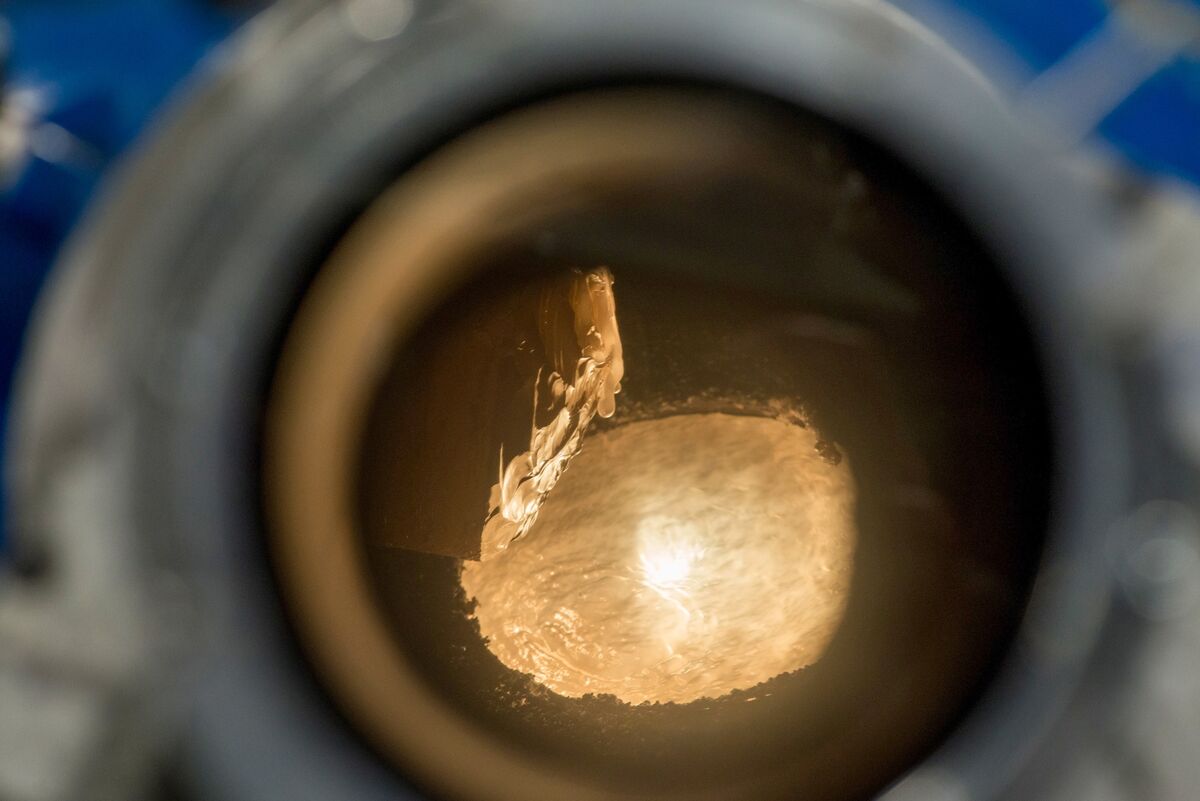

US LNG exporters plan to more than double capacity by 2029, says EIA

PositiveFinancial Markets

US LNG exporters are gearing up to more than double their capacity by 2029, according to the Energy Information Administration (EIA). This expansion is significant as it reflects the growing demand for liquefied natural gas globally, positioning the US as a key player in the energy market. Increased capacity could lead to more jobs and economic growth, while also helping to meet international energy needs.

— Curated by the World Pulse Now AI Editorial System