Tech, Media & Telecom Roundup: Market Talk

NeutralFinancial Markets

- The latest Market Talks provide insights on major players in the Technology, Media, and Telecom sectors, including Telus, Alibaba, Nvidia, and Oracle, reflecting current market trends and company performances.

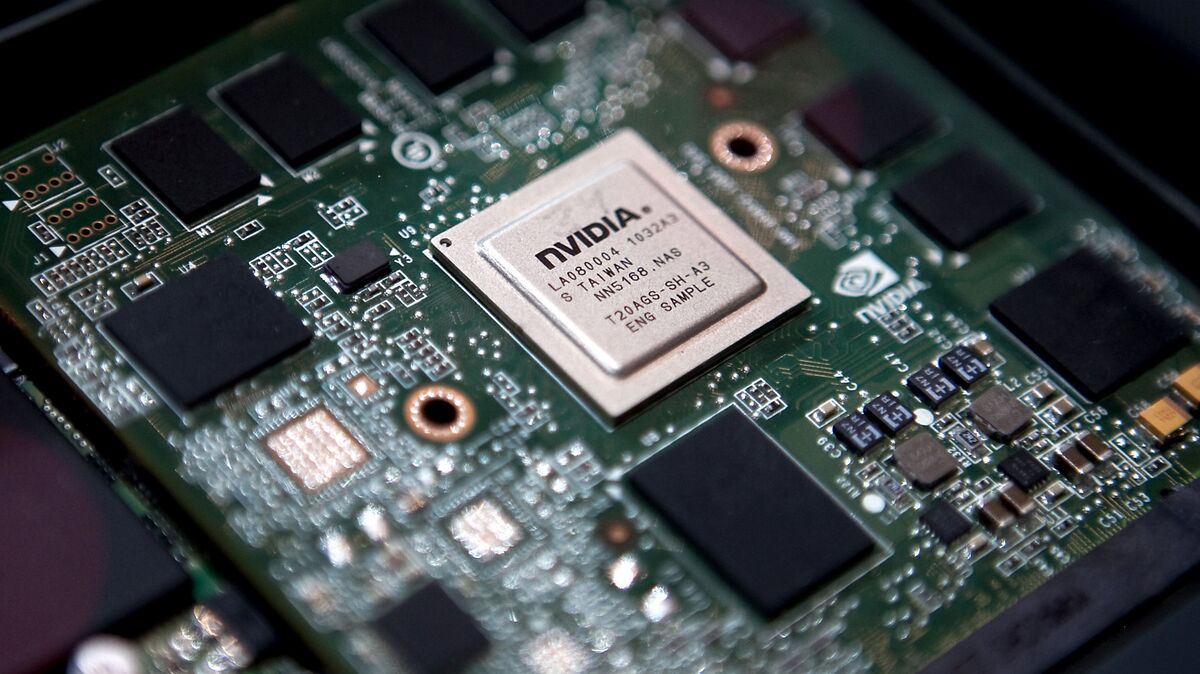

- Nvidia's anticipated earnings report is particularly significant, as it is expected to influence market dynamics amid ongoing concerns about the valuation of AI stocks. Investors are closely monitoring Nvidia's results, which could either reinforce or challenge the prevailing market sentiment.

- The broader market context reveals a mix of optimism and anxiety, with Nvidia's performance being a focal point amidst fears of an AI bubble and fluctuating investor confidence in tech stocks, highlighting the volatility and interconnectedness of the sector.

— via World Pulse Now AI Editorial System