Vietnam's economy accelerates in July-September despite drop in U.S. exports

PositiveFinancial Markets

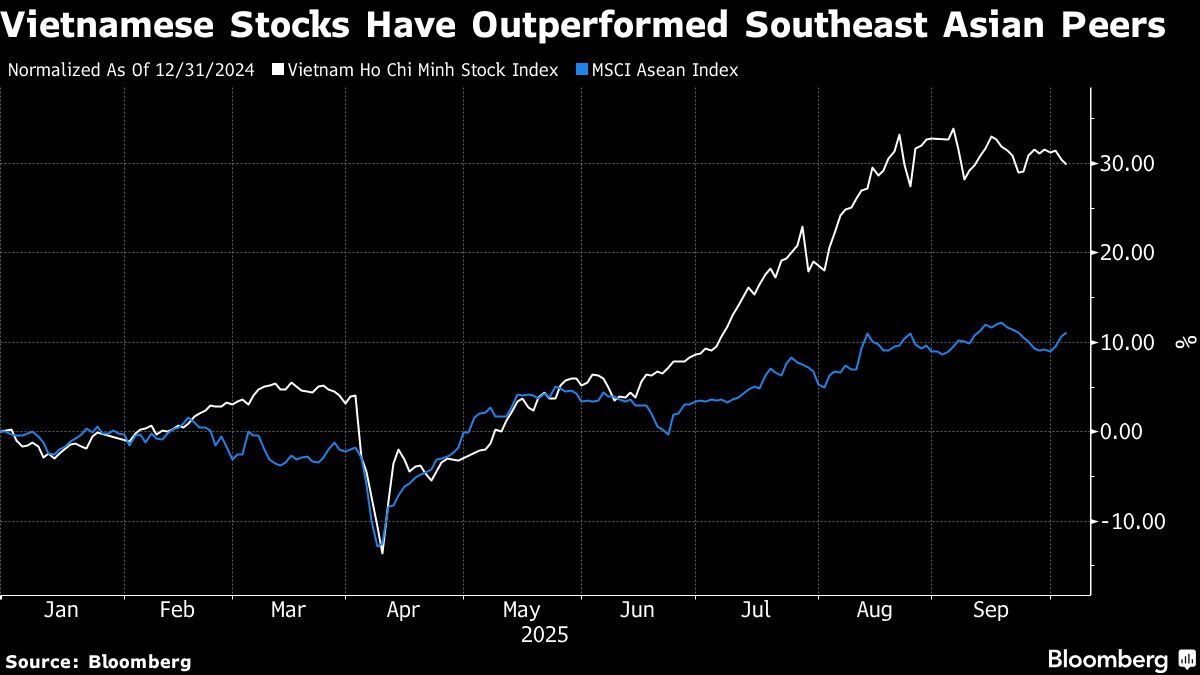

Vietnam's economy showed remarkable resilience in the July-September quarter, continuing to grow despite a decline in exports to the U.S. This growth is significant as it highlights the country's ability to adapt and thrive even in challenging global trade conditions. The positive economic indicators suggest that Vietnam is on a solid path towards recovery and development, making it an attractive destination for investors and businesses looking for opportunities.

— Curated by the World Pulse Now AI Editorial System