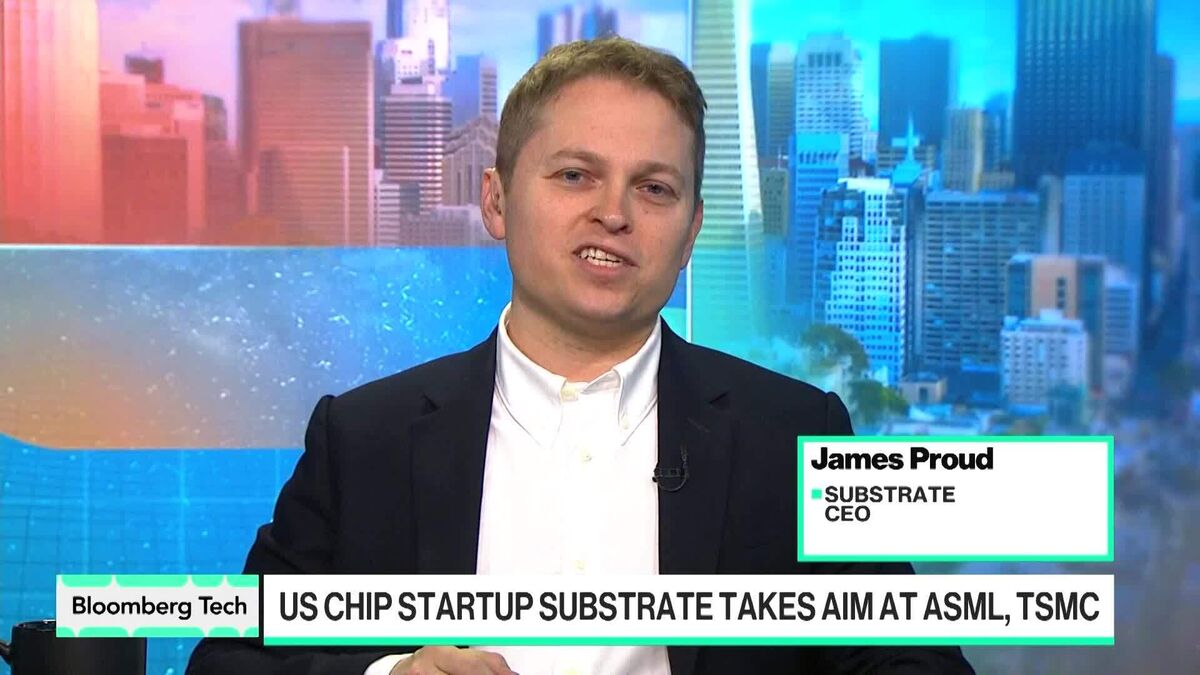

US startup Substrate announces chipmaking tool that it says will rival ASML

PositiveFinancial Markets

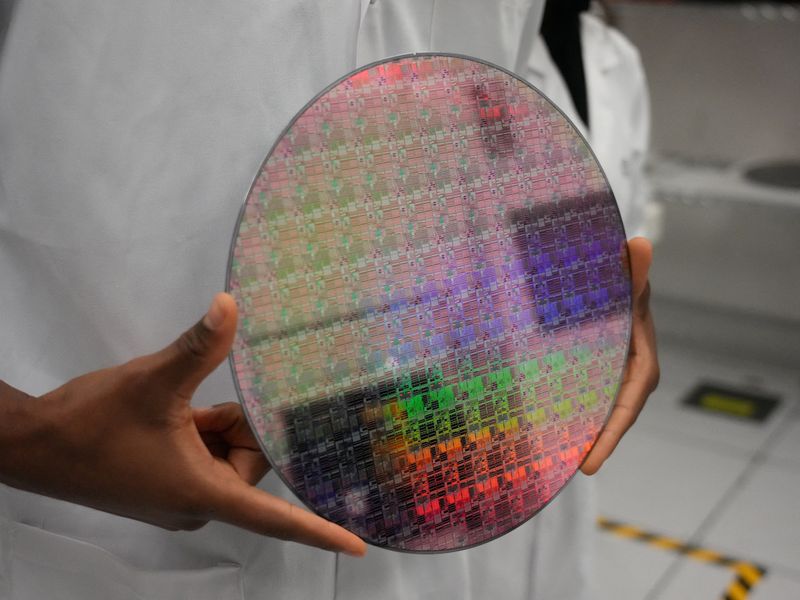

US startup Substrate has unveiled a groundbreaking chipmaking tool that aims to compete with industry giant ASML. This development is significant as it could potentially disrupt the semiconductor market, offering new capabilities and driving innovation. With the increasing demand for advanced chips in various sectors, Substrate's tool could play a crucial role in shaping the future of technology and manufacturing.

— Curated by the World Pulse Now AI Editorial System