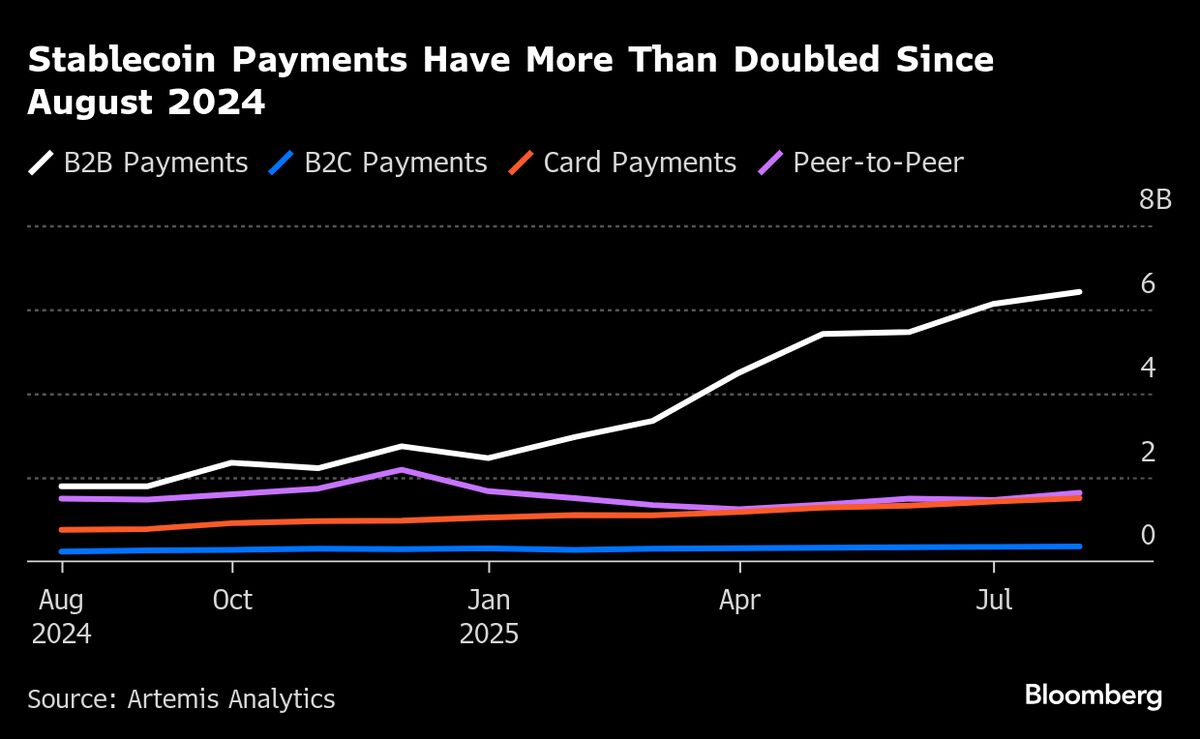

Stablecoin Use for Payments Jumps 70% Since US Regulation

PositiveFinancial Markets

Since the introduction of US regulations in July, the use of stablecoins for payments has surged by 70%. This significant increase highlights a growing acceptance of digital currencies in everyday transactions, making it easier for consumers and businesses to engage in real-world purchases. The regulation has provided a clearer framework, boosting confidence in stablecoins and their potential to revolutionize payment systems.

— Curated by the World Pulse Now AI Editorial System