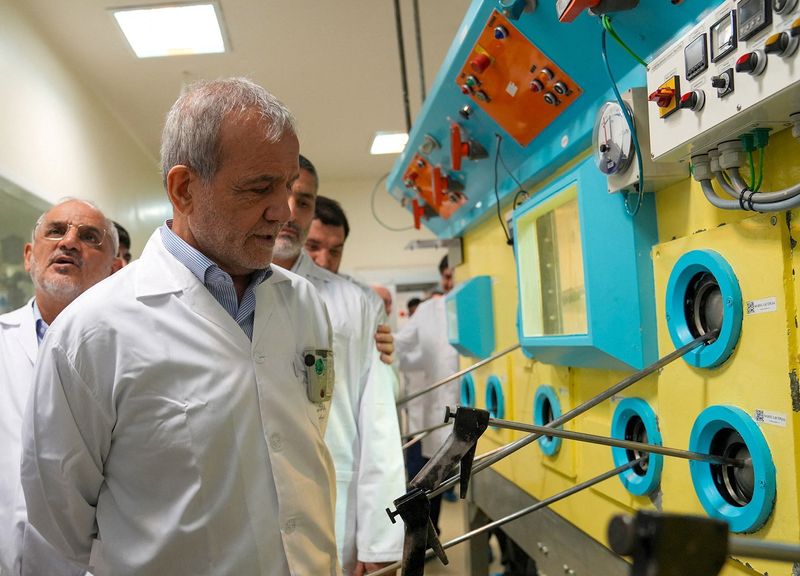

Iran’s president says Tehran will rebuild its nuclear facilities

NegativeFinancial Markets

Iran's president has announced plans to rebuild the country's nuclear facilities, a move that raises significant concerns among international observers. This development is crucial as it could escalate tensions in the region and impact global nuclear non-proliferation efforts. The decision reflects Iran's determination to advance its nuclear capabilities, which may provoke reactions from other nations and influence diplomatic relations.

— Curated by the World Pulse Now AI Editorial System