European Banks’ Growing Risk-Taking to Pay Off With Revenue Lift

PositiveFinancial Markets

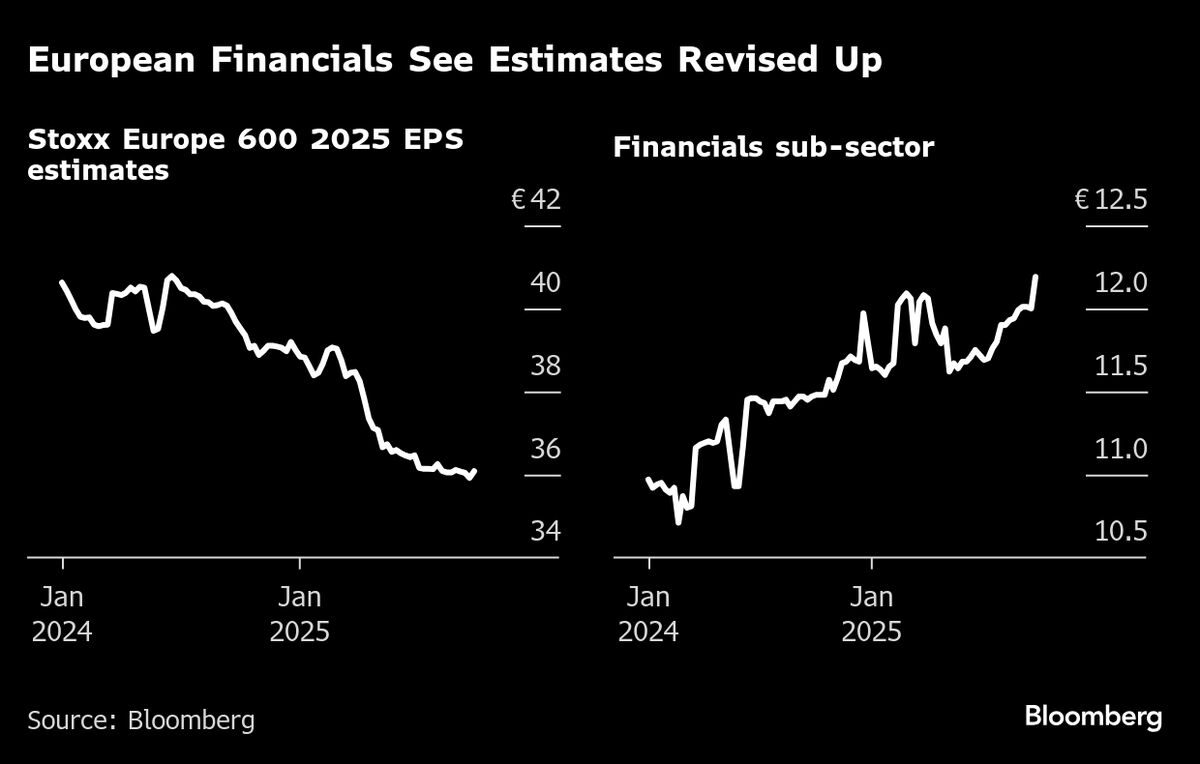

European banks are increasingly taking on leveraged loans, which is leading to a promising boost in their revenue prospects. This trend not only highlights their growing risk appetite but also suggests that earnings estimates may be raised, indicating a positive outlook for the banking sector. It's an exciting time for these institutions as they navigate new opportunities for growth.

— Curated by the World Pulse Now AI Editorial System