Argentina’s Economy Chief Says US Willing to Keep Buying Pesos

PositiveFinancial Markets

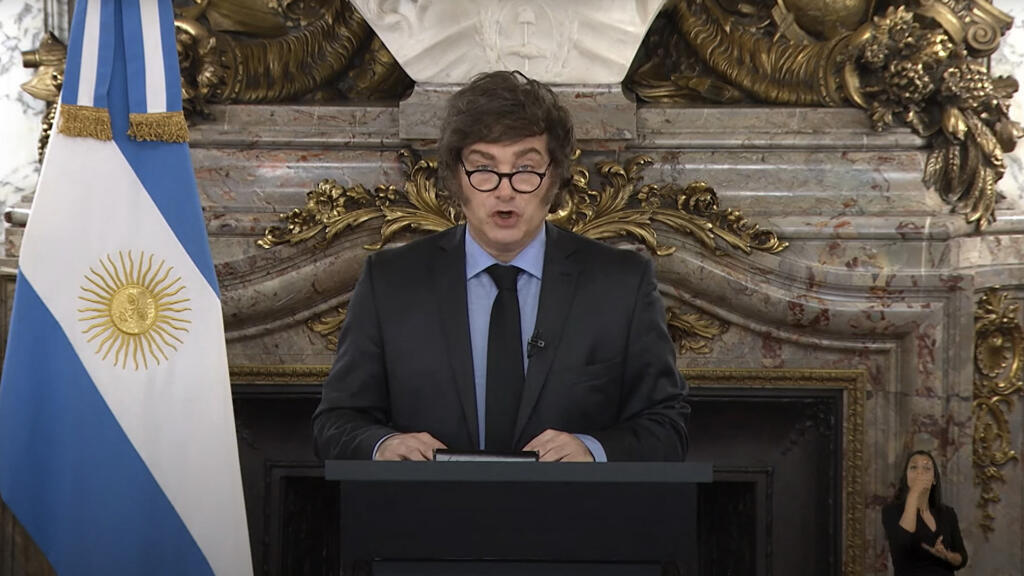

Argentina's economy chief has announced that the US is committed to supporting the peso, which is great news as President Javier Milei prepares for an important trip to Washington. This backing could stabilize Argentina's economy during a critical time, especially with the upcoming midterm vote. It highlights the strengthening ties between the two nations and offers hope for economic recovery in Argentina.

— Curated by the World Pulse Now AI Editorial System