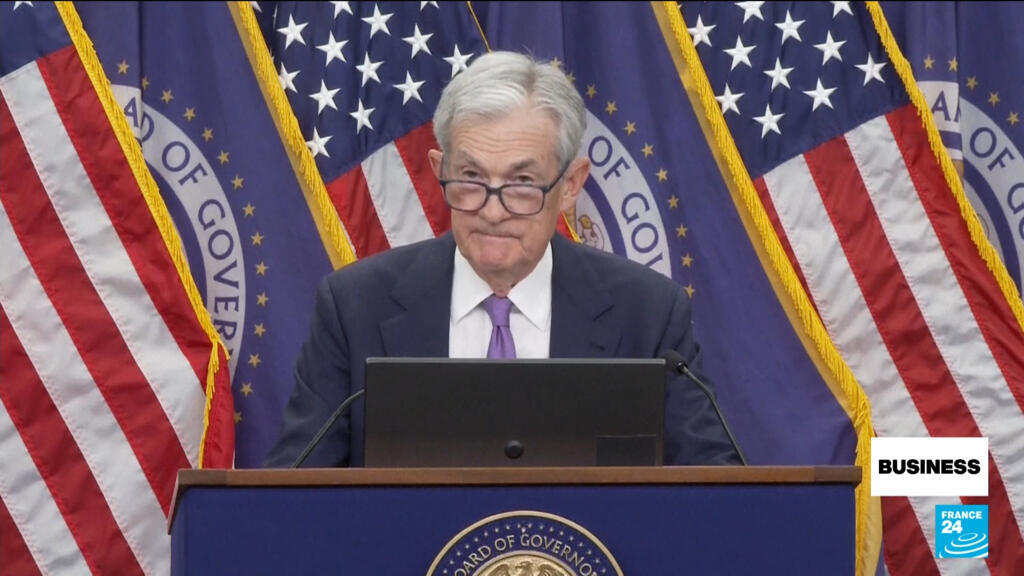

US Federal Reserve cuts rates again but cautions another in December is far from certain

NeutralFinancial Markets

The US Federal Reserve has made the decision to cut interest rates for the second time this year, bringing the Federal Funds Rate to a range of 3.75% to 4%. This move comes amid uncertainty due to the ongoing government shutdown, which has limited the data available for assessing the economy. Additionally, the Fed plans to halt the reduction of its balance sheet in December. In related news, Boeing reported a significant loss of $5.4 billion in the third quarter, primarily due to delays in the rollout of its 777X aircraft. These developments are crucial as they reflect the Fed's cautious approach to monetary policy in a turbulent economic environment.

— Curated by the World Pulse Now AI Editorial System