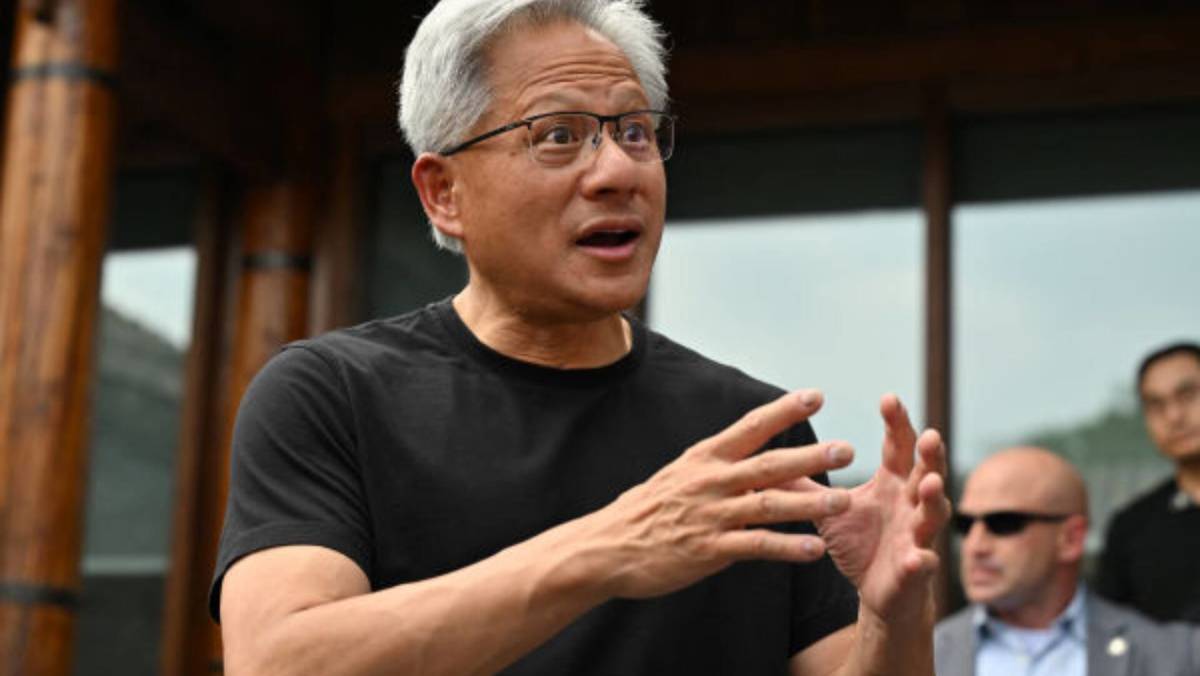

Nvidia-UAE chip deal remains in limbo, frustrating CEO Huang- WSJ

NegativeFinancial Markets

The ongoing uncertainty surrounding Nvidia's chip deal with the UAE has left CEO Jensen Huang frustrated. This situation is significant as it highlights the challenges tech companies face in navigating international partnerships, especially in the semiconductor industry, which is crucial for global technology advancements.

— Curated by the World Pulse Now AI Editorial System