Tech Buying Pushes S&P 500, Nasdaq to New Records

PositiveFinancial Markets

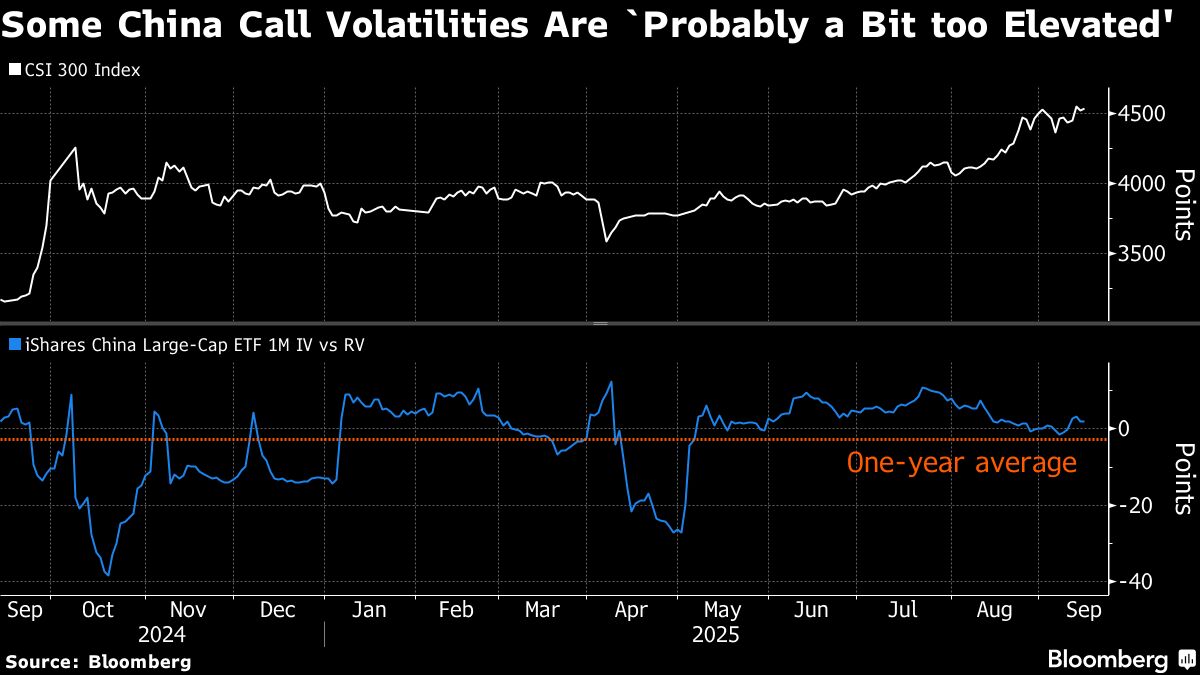

The S&P 500 and Nasdaq have reached new record highs, driven by positive investor sentiment stemming from improved U.S.-China trade relations and expectations of interest rate cuts.

Editor’s Note: This development is significant as it reflects growing confidence in the market, which could lead to increased investment and economic growth. The thawing trade relations between the U.S. and China are particularly important, as they have been a source of uncertainty for investors.

— Curated by the World Pulse Now AI Editorial System