JPM’s Rohrbaugh on National Security Investment, Credit

PositiveFinancial Markets

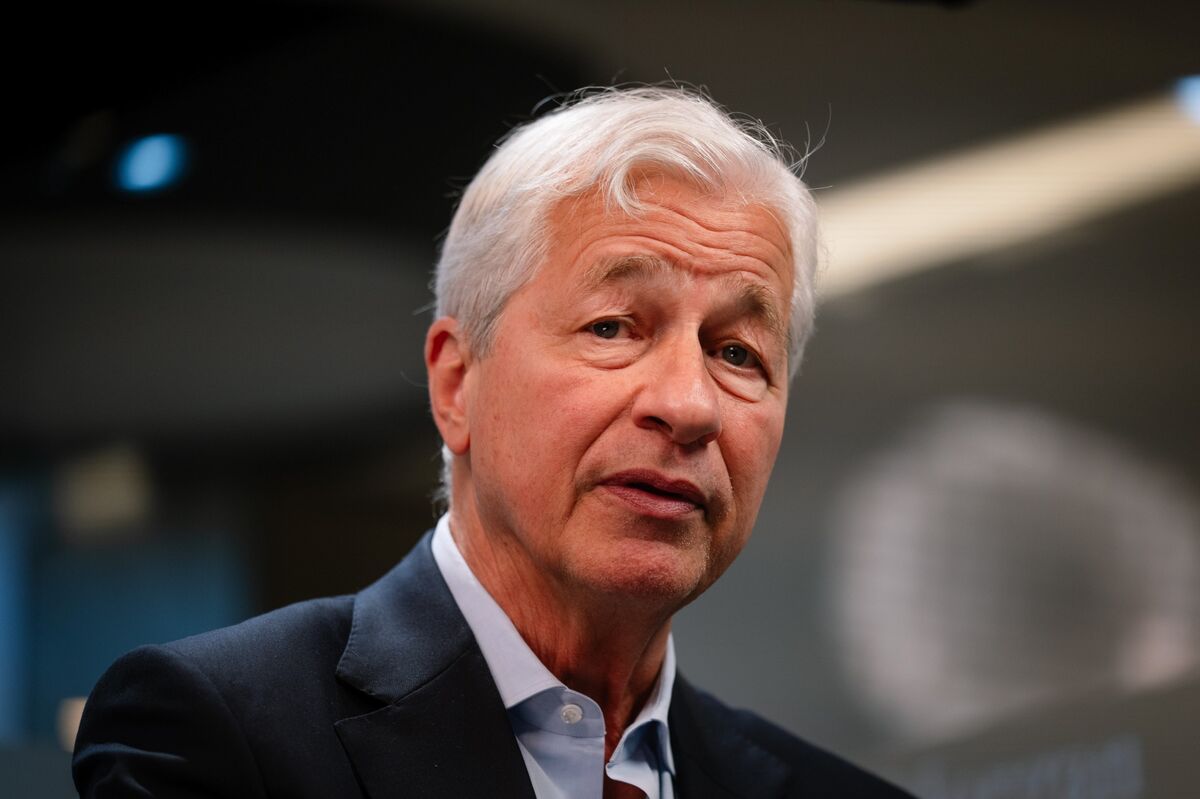

JPMorgan Chase's co-CEO Troy Rohrbaugh recently shared exciting news about the bank's commitment to invest $10 billion in US national security. In an interview with Lisa Abramowicz on Bloomberg, he highlighted a strong banking pipeline and promising growth opportunities, particularly in international markets. This investment not only underscores JPMorgan's confidence in the economy but also reflects a strategic move to bolster national security, making it a significant development for both the bank and the country.

— Curated by the World Pulse Now AI Editorial System