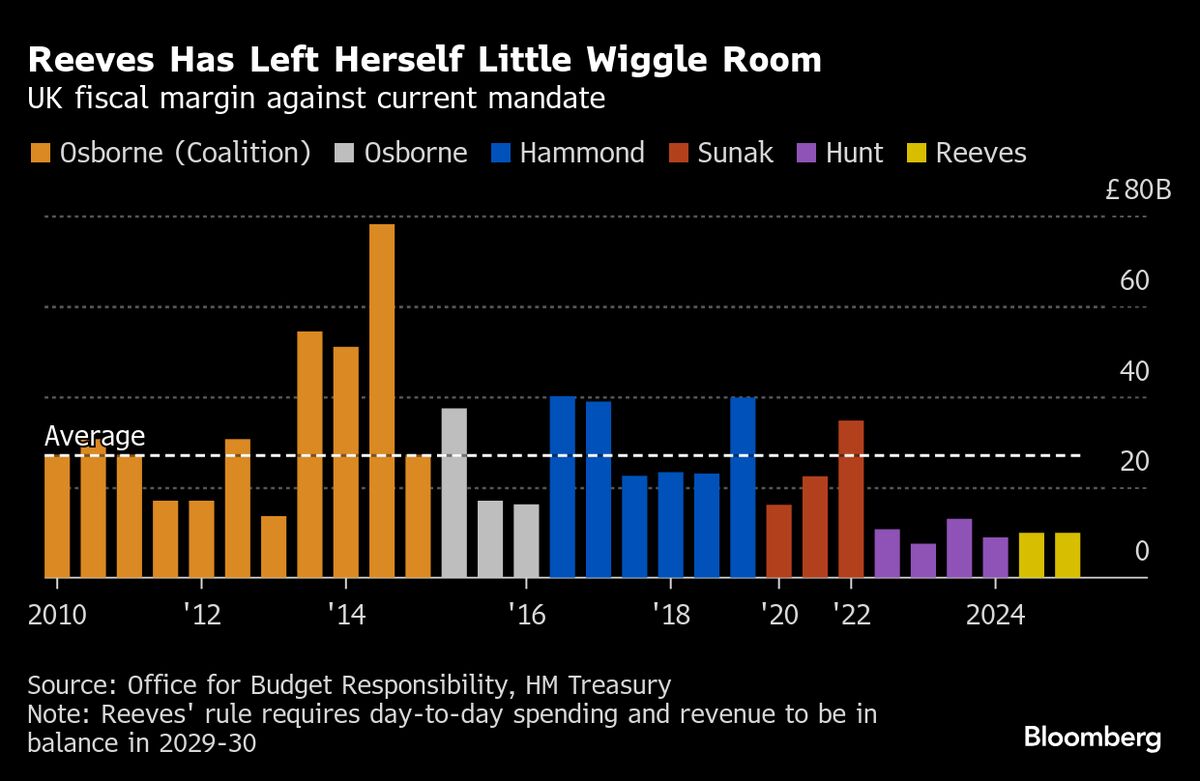

UK’s Reeves Hints at Increased Fiscal Buffer at Budget

PositiveFinancial Markets

UK Chancellor Rachel Reeves is hinting at the possibility of increasing the fiscal buffer in the upcoming budget, emphasizing the importance of having a safety net in today's unpredictable economic climate. This move could provide the UK with more flexibility to manage financial shocks, which is crucial for maintaining economic stability. Reeves' discussions with Lisa Abramowicz at the IMF meeting highlight the government's proactive approach to fiscal management, aiming to strike a balance between necessary taxation and economic resilience.

— Curated by the World Pulse Now AI Editorial System