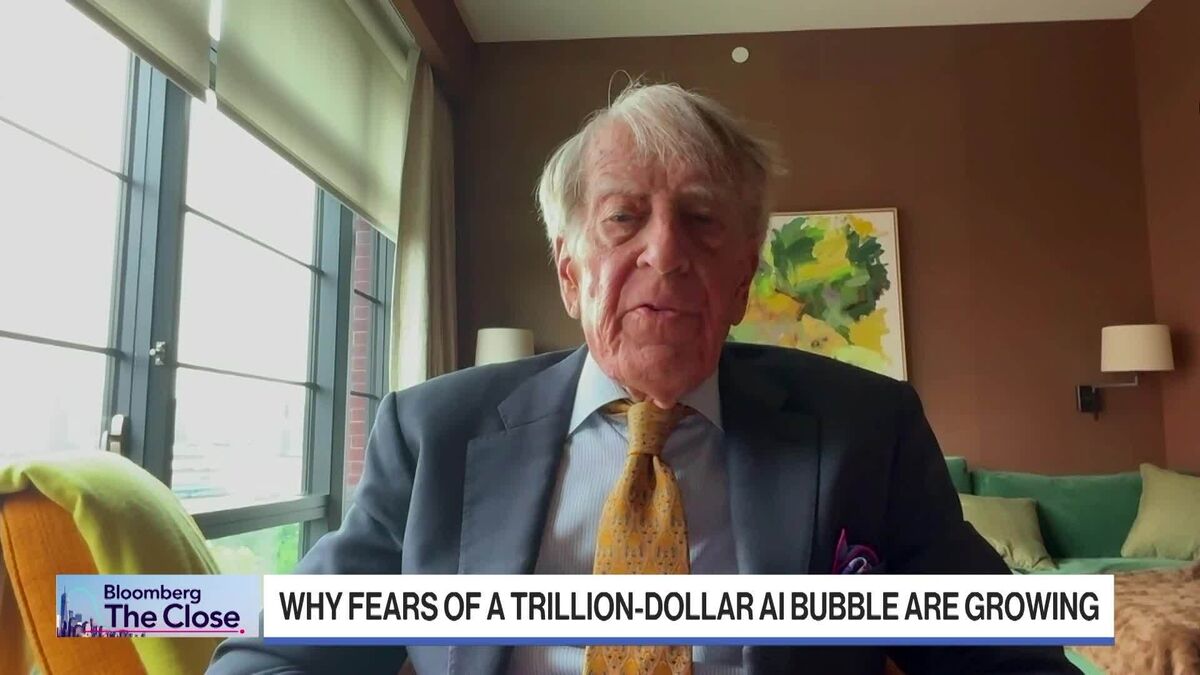

Shutdown is costing US economy $15 billion a day, Bessent says

NegativeFinancial Markets

The ongoing government shutdown is having a significant impact on the US economy, costing an estimated $15 billion each day, according to financial expert Bessent. This situation not only affects federal employees and services but also has broader implications for businesses and consumers, potentially slowing down economic growth and leading to increased uncertainty in the market.

— Curated by the World Pulse Now AI Editorial System