Michigan survey ahead; Applied Digital surges; gold dips - what’s moving markets

NeutralFinancial Markets

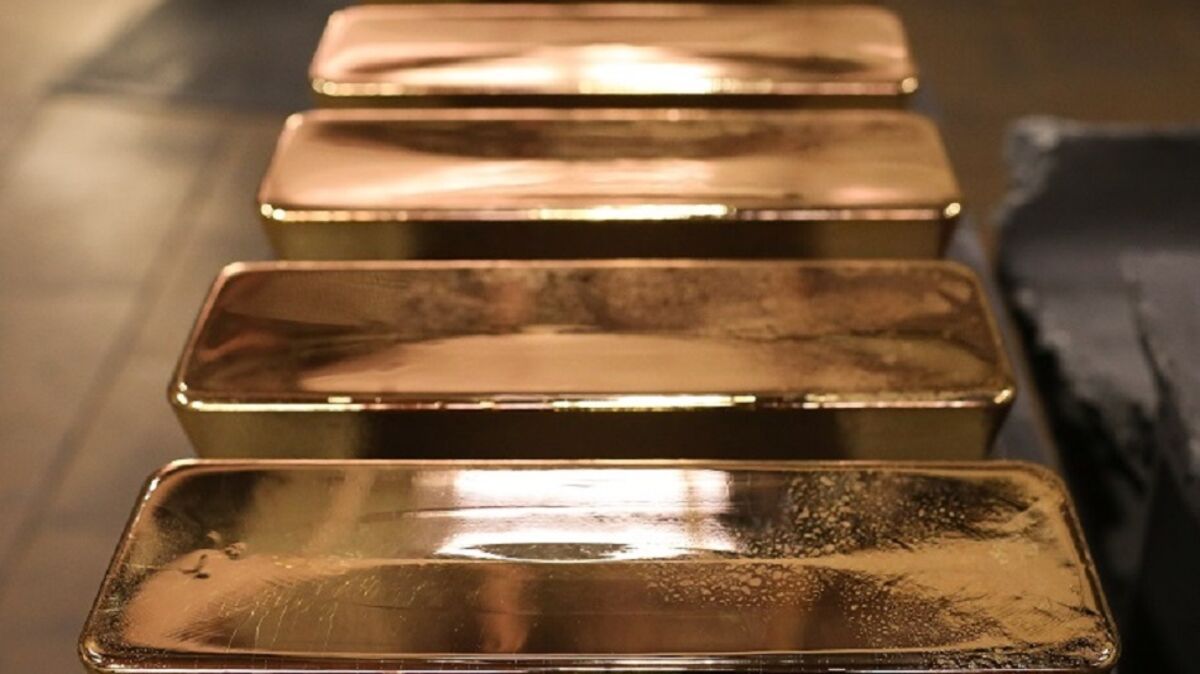

In the latest market updates, a Michigan survey is set to influence economic forecasts, while Applied Digital has seen a significant surge in its stock prices. Meanwhile, gold prices have dipped, reflecting changing investor sentiments. These developments are crucial as they indicate shifts in market dynamics and investor confidence, which can impact various sectors and individual investments.

— Curated by the World Pulse Now AI Editorial System