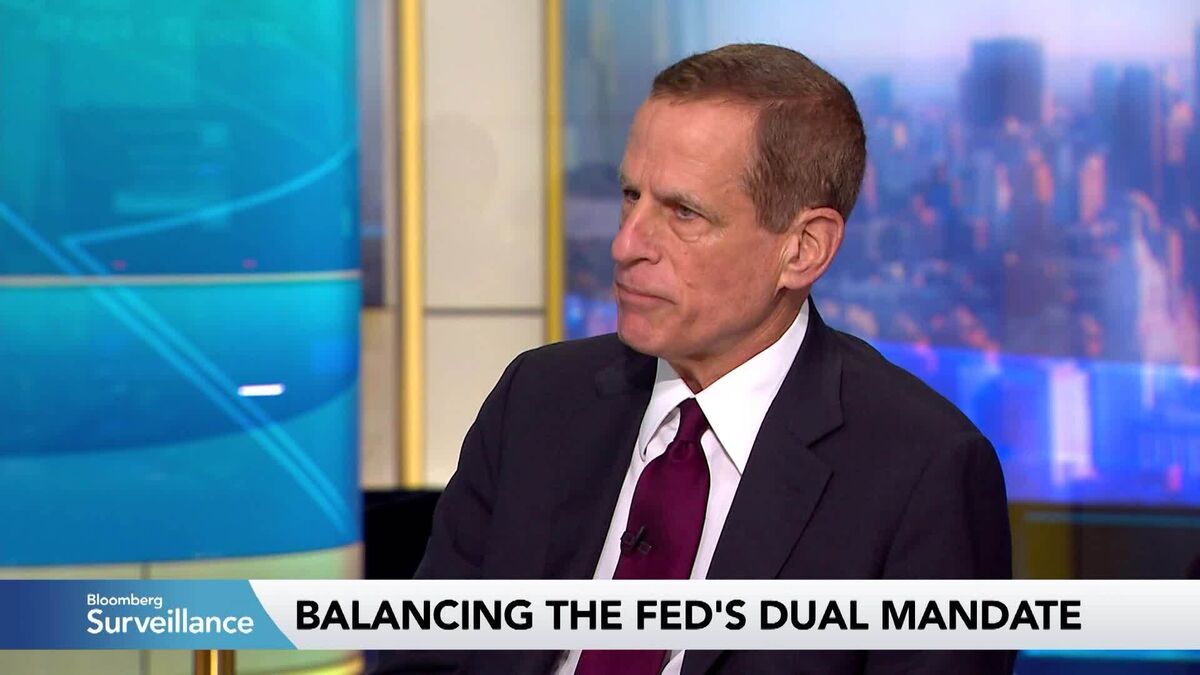

JPMorgan Sees Fed Reviving 2019 Playbook to Ease Market Strains

PositiveFinancial Markets

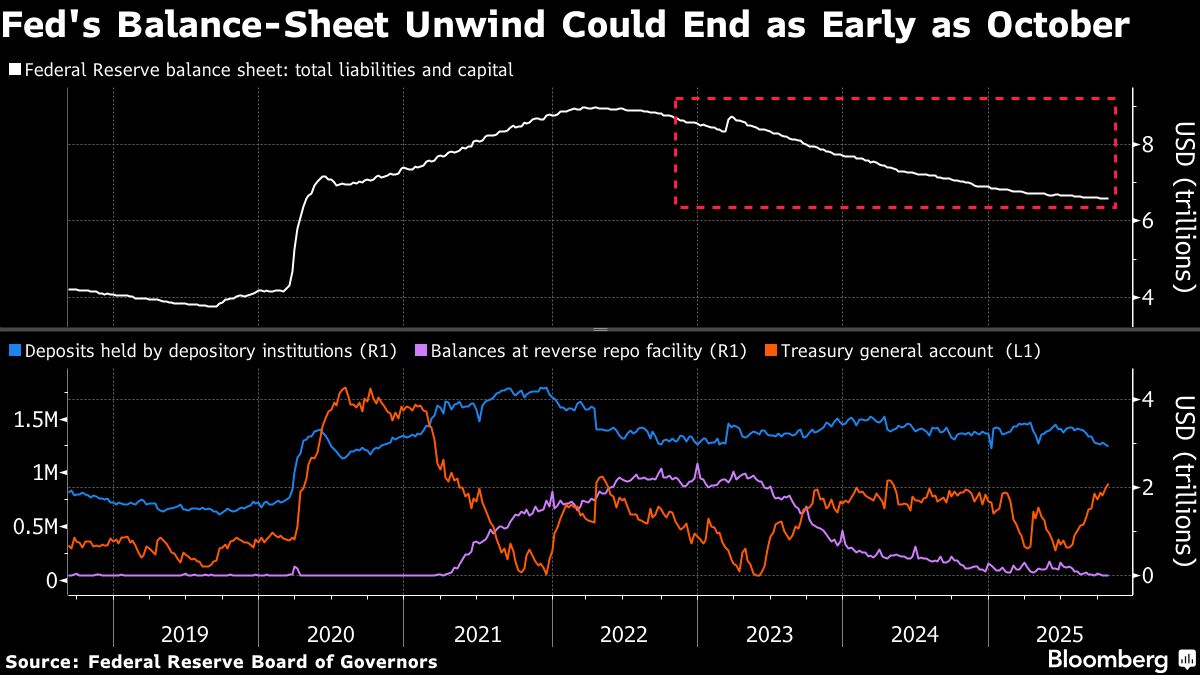

JPMorgan Chase & Co. has indicated that the Federal Reserve is poised to implement measures to alleviate ongoing pressures in funding markets, which are expected to continue even after the anticipated end of its balance-sheet unwinding. This is significant as it suggests proactive steps by the Fed to stabilize the financial landscape, potentially fostering a more favorable environment for investors and businesses alike.

— Curated by the World Pulse Now AI Editorial System