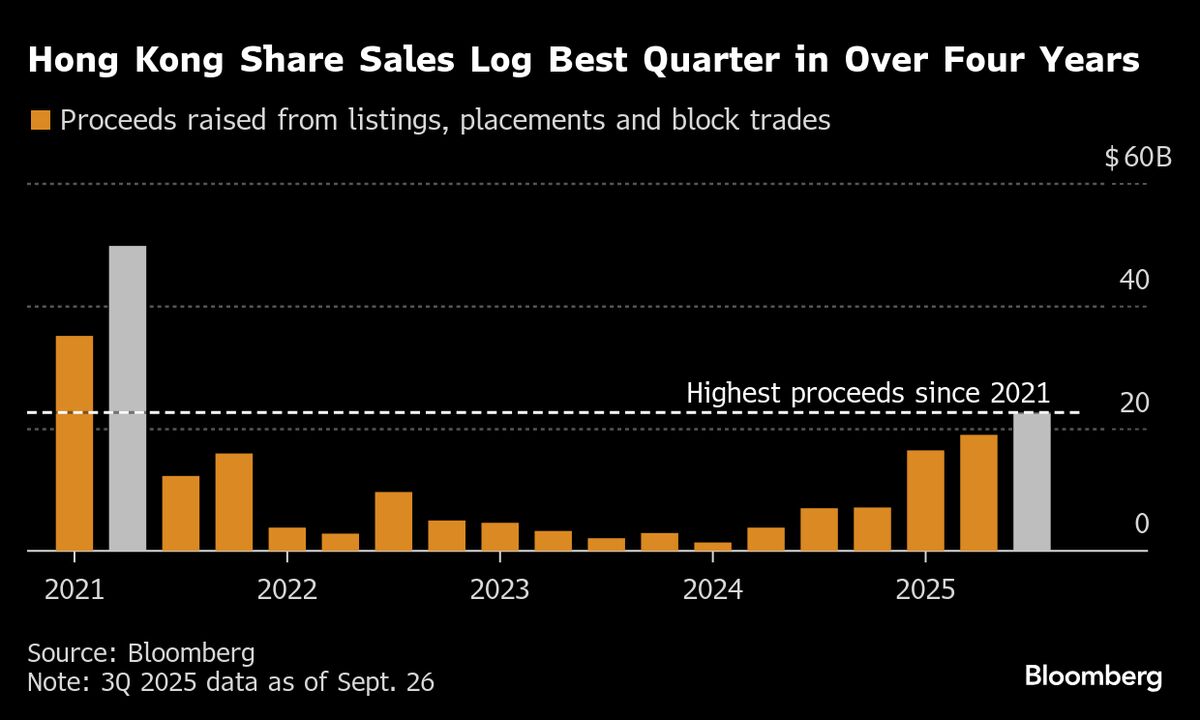

Hong Kong and India Drive Banner Year for Equity Capital Markets

PositiveFinancial Markets

This year has been remarkable for equity capital markets, with Hong Kong and India leading the charge. Bankers in Asia are gearing up for a strong finish, highlighting the resilience and growth potential in these regions. This surge in activity not only reflects investor confidence but also sets the stage for future opportunities in the market.

— Curated by the World Pulse Now AI Editorial System