Inside Intel’s big bet to save US chipmaking — and itself

PositiveFinancial Markets

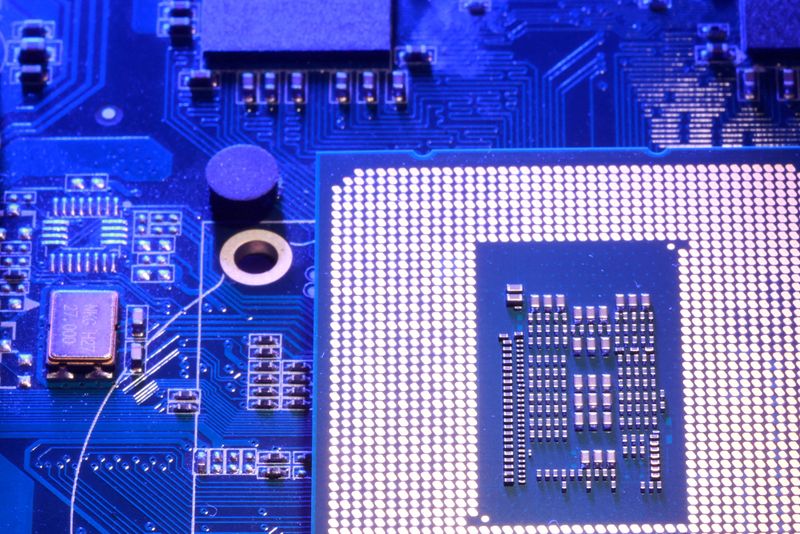

Intel is making a significant investment in its new facility in Arizona, aiming to revitalize US chipmaking and secure its own future. This move comes as the company claims to have achieved a breakthrough in chip technology, which will be crucial for meeting the demands of skeptical Big Tech customers. The success of this initiative could not only bolster Intel's position in the competitive semiconductor market but also strengthen the US's role in global chip production, making it a pivotal moment for the industry.

— Curated by the World Pulse Now AI Editorial System