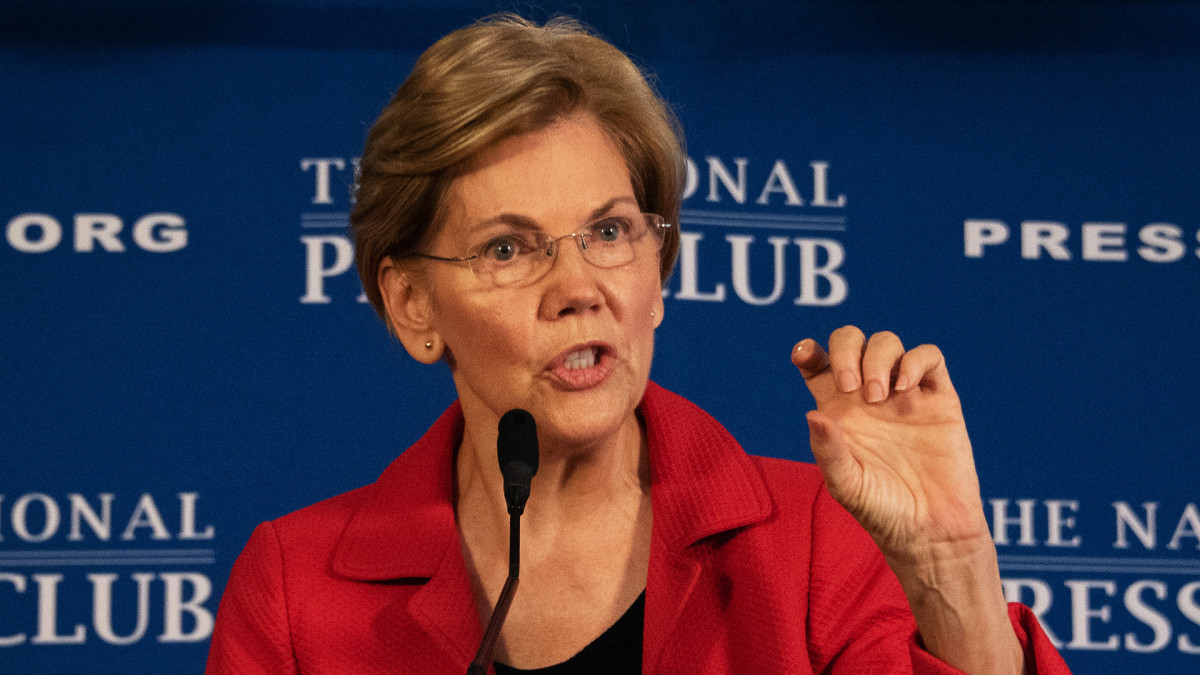

Elizabeth Warren slams Paramount's Warner Bros. move

NegativeFinancial Markets

- Elizabeth Warren has criticized Paramount's recent actions regarding the acquisition of Warner Bros. Discovery by Netflix, which was announced for $72 billion. Warren's stance highlights concerns over antitrust laws and the potential for reduced competition in the entertainment market.

- This development is significant as it underscores the ongoing tensions in the media landscape, where major players like Netflix and Paramount are vying for dominance. Warren's criticism reflects broader anxieties about market consolidation and its impact on consumer choice.

- The competitive bidding process for Warner Bros. Discovery illustrates the escalating rivalry among major media companies, with Paramount's hostile bid of $108.4 billion directly challenging Netflix's acquisition. This situation raises questions about regulatory scrutiny and the future of competition in the entertainment industry.

— via World Pulse Now AI Editorial System