What is the energy price cap for Great Britain, and can I cut my bill?

NeutralFinancial Markets

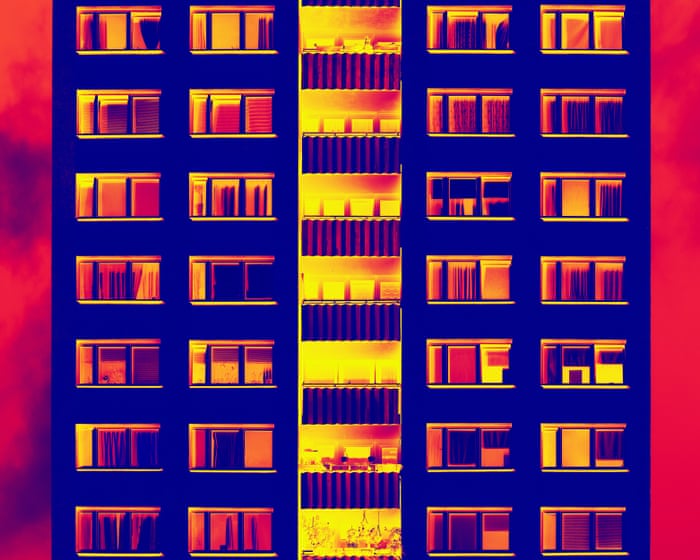

The energy price cap in Great Britain is set to increase on Wednesday, which could impact many households this winter. However, if you're currently on your provider's standard tariff, there's still a chance to lower your energy bills by exploring better deals in the market. This is important as it encourages consumers to take action and potentially save money during a time when energy costs are rising.

— Curated by the World Pulse Now AI Editorial System