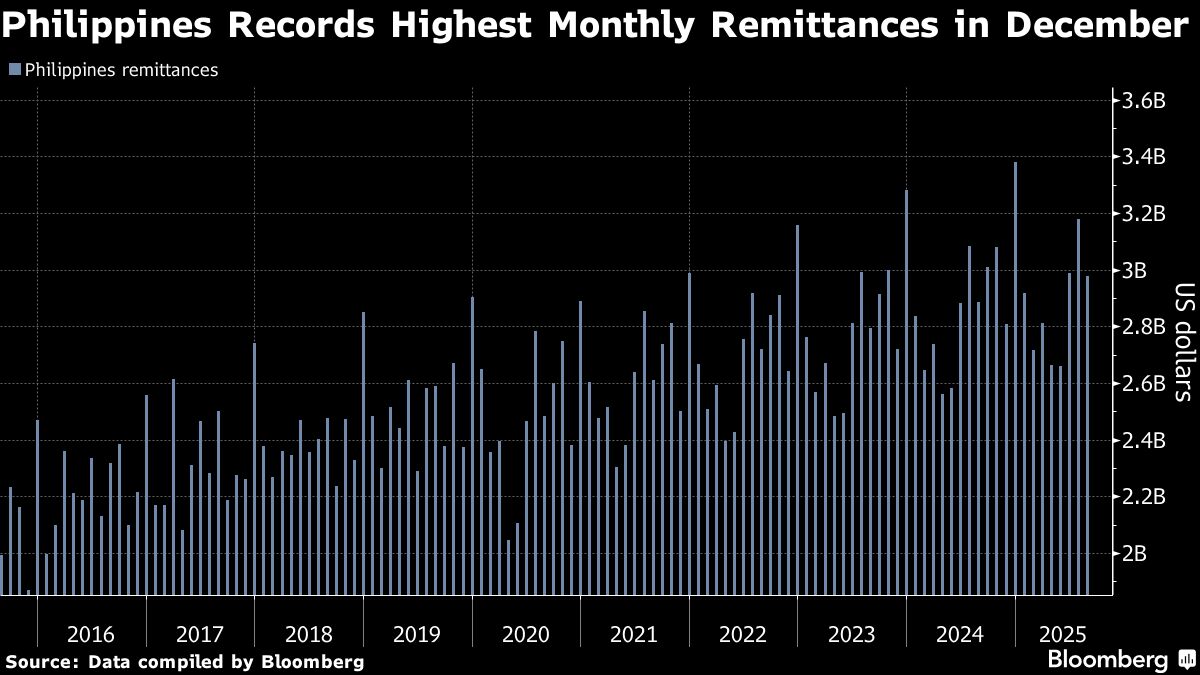

Philippine Peso Rebounds as Central Bank Denies Watching Levels

PositiveFinancial Markets

The Philippine peso has shown signs of recovery after hitting a record low, as the central bank reassures market participants that it is not closely monitoring currency levels. This rebound is significant as it reflects growing confidence in the economy and the central bank's ability to manage currency fluctuations, which can impact trade and investment.

— Curated by the World Pulse Now AI Editorial System