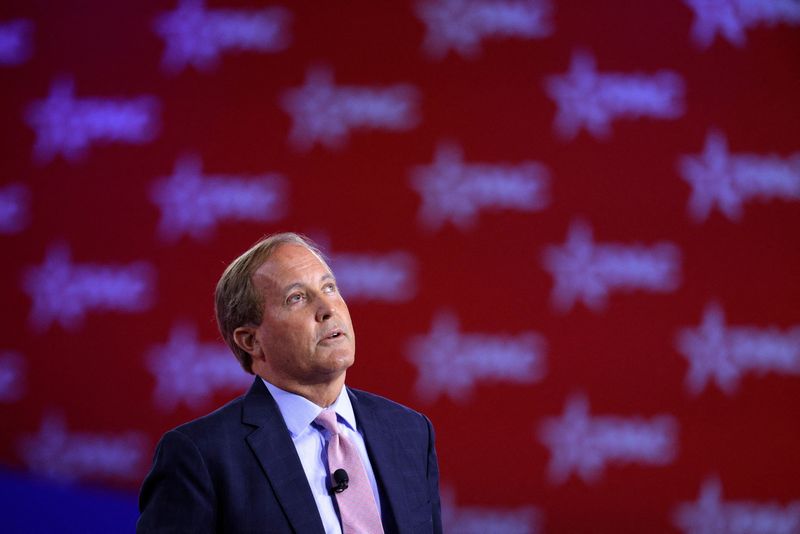

Texas AG probes proxy advisers Glass Lewis, ISS amid ESG backlash

NeutralFinancial Markets

The Texas Attorney General is investigating proxy advisory firms Glass Lewis and ISS in response to growing backlash against Environmental, Social, and Governance (ESG) practices. This inquiry highlights the ongoing debate over the influence of proxy advisers on corporate governance and shareholder decisions. As ESG considerations become increasingly prominent in investment strategies, this investigation could have significant implications for how these firms operate and the broader corporate landscape.

— Curated by the World Pulse Now AI Editorial System