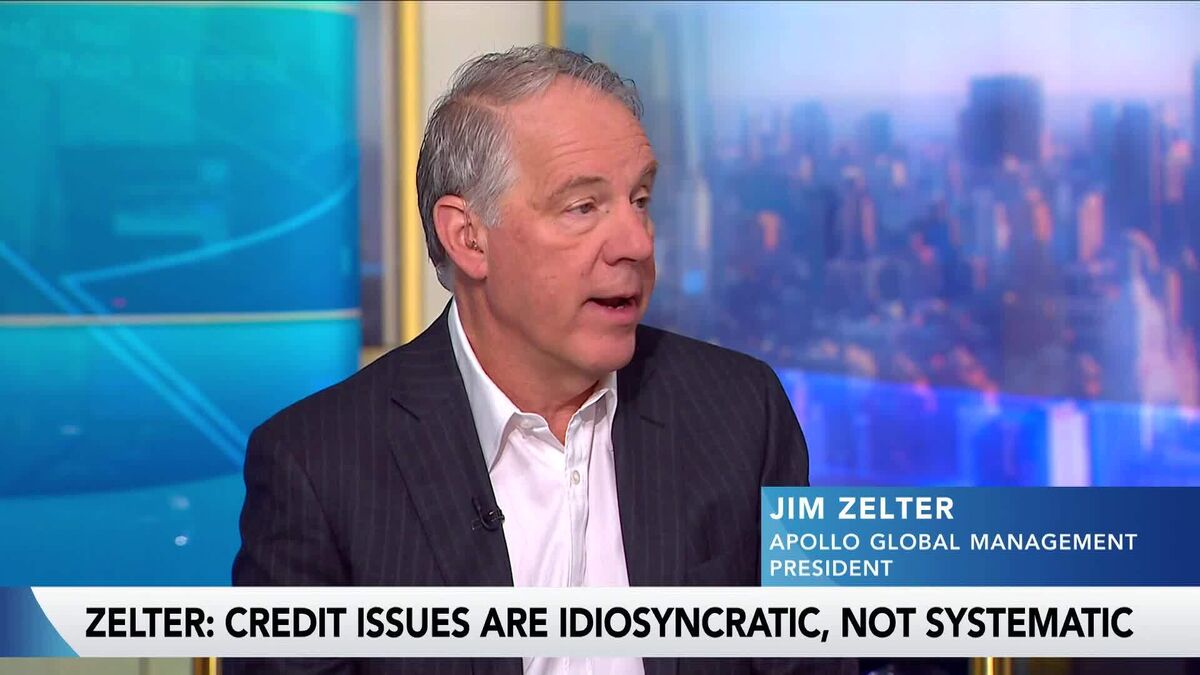

Bloomberg Brief 11/05/2025 (Video)

NeutralFinancial Markets

Bloomberg Brief 11/05/2025 (Video)

The Bloomberg Brief video released on November 5, 2025, provides a concise overview of the latest developments in finance and business. This video is significant as it keeps viewers informed about market trends and economic insights, helping them make informed decisions in a rapidly changing financial landscape.

— via World Pulse Now AI Editorial System