Meta's Jumbo Bond Sale Draws Record Orders, $125B

PositiveFinancial Markets

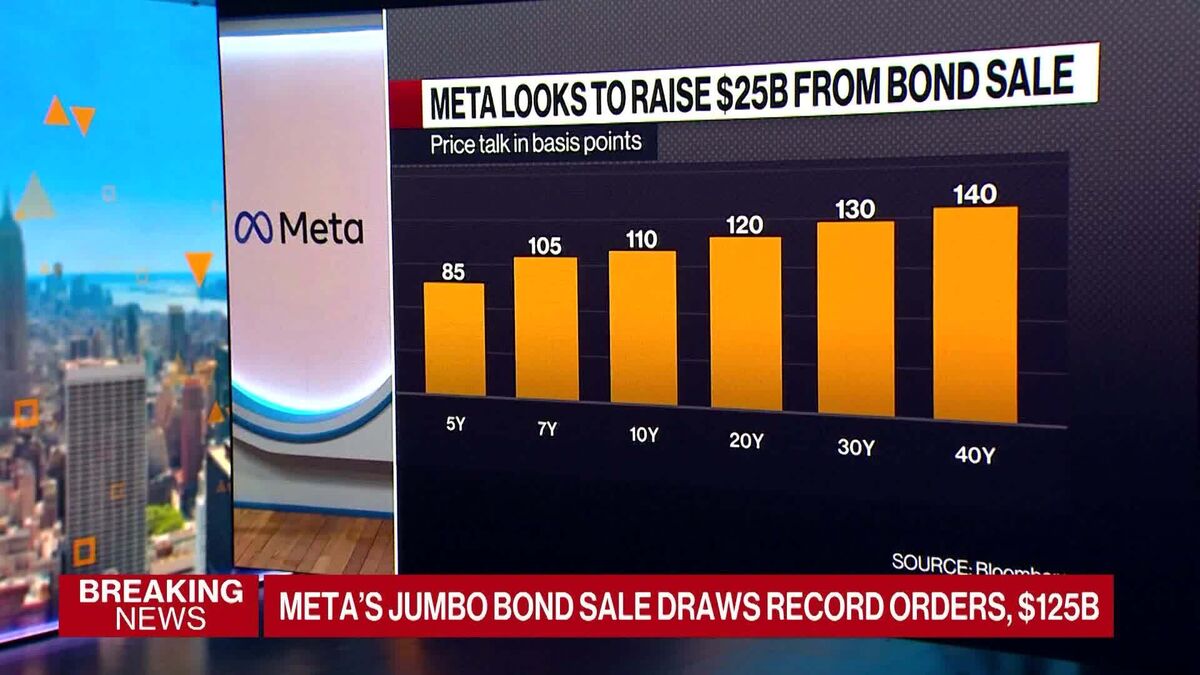

Meta Platforms Inc. has made headlines with its recent corporate bond sale, attracting a staggering $125 billion in orders, the highest ever recorded for such an offering. This remarkable interest not only highlights investor confidence in Meta's future but also underscores the company's strong market position. As the tech giant continues to innovate and expand, this bond sale could provide significant capital for its ambitious projects, making it a noteworthy event in the financial landscape.

— Curated by the World Pulse Now AI Editorial System